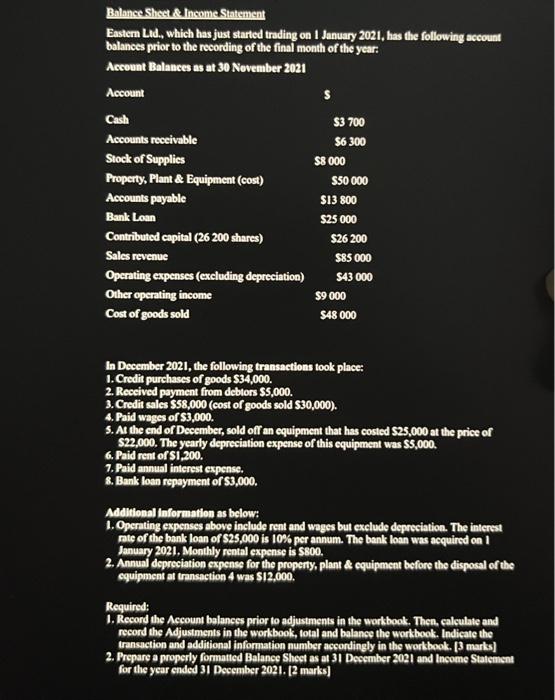

Question: Balance Sheet & Income Statement Eastern Ltd., which has just started trading on 1 January 2021, has the following account balances prior to the recording

Balances Shere A. Income Sintement Eastern Lad, which has just started trading on I January 2021, has the following account balances prior to the recording of the final month of the year. Account Balances as at 30 November 2021 Acoount Cash Accounts receivable Stock of Supplics Property, Plant \& Equipment (cost) Accounts payable Bank Loan Contributed capital (26 200 shares) Sales revenue Openting expenses (excluding depreciation) s Other operating income $3700 $6300 Cost of goods sold $8000 50000 $13800 $25000 $26200 $85000 $43000 $9000 548000 In December 2021, the following transactions took place: 1. Credit purchases of goods $34,000. 2. Recelved payment from debtors $5,000. 3. Credit sales $58,000 (cost of goods sold $30,000 ). 4. Paid wages of 53,000 . 5. As the cnd of December, sold off an equipment that has costed 25,000 at the price of $22,000. The yearly depreciation expense of this equipment was $5,000. 6. Paid rent of $1,200. 7. Paid annual interest expense. 8. Bank loan repayment of $3,000. Addinional Information as below: 1. Openting expenses above include rent and wages but exclude deprociation. The interest nte of the bank loan of $25,000 is 10% per annum. The bank lan was acepired on 1 January 2021. Monthly rental expense is 5800 . 2. Annual depreciation expenes for the property, plant \& equipment before the disposal of the equipment af transaction 4 was $12,000. Required: 1. Record the Account balances prior to adjustments in the work boak. Then, ealculate and record the Adjustments in the workbook, total and balanes the work book. Indicate the transaction and additional information number aceondingly in the workbook. [3 marts] 2. Prepare a properly formatted Balanee Shest as at 31 Desember 2021 and Income Statement for the year ended 31 December 2021. [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts