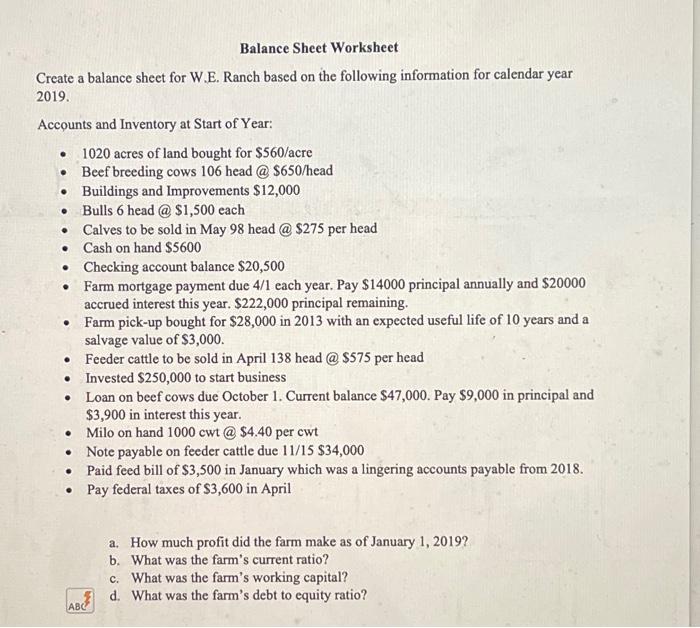

Question: Balance Sheet Worksheet Create a balance sheet for W.E. Ranch based on the following information for calendar year 2019. Accounts and Inventory at Start of

Balance Sheet Worksheet Create a balance sheet for W.E. Ranch based on the following information for calendar year 2019. Accounts and Inventory at Start of Year: - 1020 acres of land bought for $560/ acre - Beef breeding cows 106 head @ $650/ head - Buildings and Improvements $12,000 - Bulls6head @ \$1,500 each - Calves to be sold in May 98 head @ \$275 per head - Cash on hand $5600 - Checking account balance $20,500 - Farm mortgage payment due 4/1 each year. Pay $14000 principal annually and $20000 accrued interest this year. $222,000 principal remaining. - Farm pick-up bought for $28,000 in 2013 with an expected useful life of 10 years and a salvage value of $3,000. - Feeder cattle to be sold in April 138 head @ \$575 per head - Invested $250,000 to start business - Loan on beef cows due October 1. Current balance $47,000. Pay $9,000 in principal and $3,900 in interest this year. - Milo on hand 1000cwt@$4.40 per cwt - Note payable on feeder cattle due 11/15$34,000 - Paid feed bill of $3,500 in January which was a lingering accounts payable from 2018. - Pay federal taxes of $3,600 in April a. How much profit did the farm make as of January 1,2019 ? b. What was the farm's current ratio? c. What was the farm's working capital? d. What was the farm's debt to equity ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts