Question: balance using double the straight 1ine rate , and [3} units-of- production for 201? through to 2021 . 2. 46800 i 3. Which method results

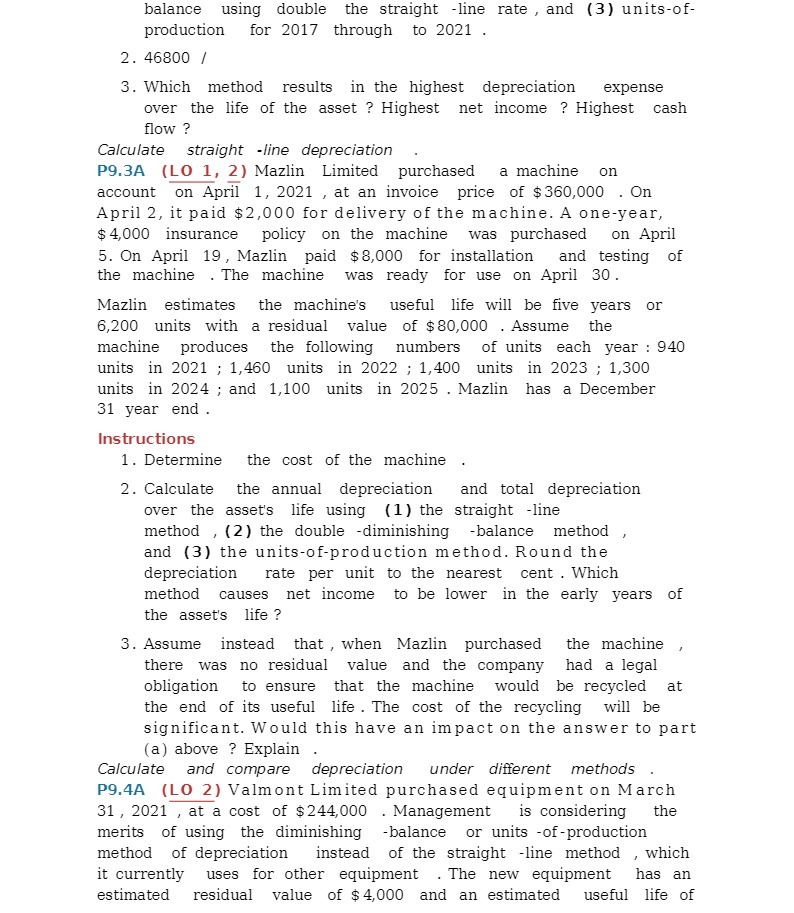

balance using double the straight 1ine rate , and [3} units-of- production for 201? through to 2021 . 2. 46800 i 3. Which method results in the highest depreciation expense over the life of the asset ? Highest net income ? Highest cash ow ? Caicuiate straight -iine depreciation . PQBA {L0I 1, 2} Mazlin Limited purchased a machine on account on Apr 1. 2021 , at an invoice price of $360,000 . On April 2, it paid $2,000 for delivery of the machine. A oneyear, $4,000 insurance policy on the machine was purchased on April 5. On April 19, Mazlin paid $8,000 for installation and testing of the machine .The machine was ready for use on April 30. Mazlin estimates the machine's useful life will be five years or 5,200 units with a residual value of $80,000 . Assume the machine produces the following numbers of units each year : 040 units in 2021 ; 1,460 units in 2022 ; 1,400 units in 2023 ; 1,300 units in 2024 ,- and 1,100 units in 2025 . Mazlin has a December 31 year end. Instructions 1. Determine the cost of the machine 2. Calculate the annual depreciation and total depreciation over the assets life using {1} the straight -line method , {2} the double diminishing balance method , and {3} the unitsofproduction method. Round the depreciation rate per unit to the nearest cent . Which method causes net income to he lower in the early years of the assets life? 3. Assume instead that , when Mazlin purchased the machine , there was no residual value and the company had a legal obligation to ensure that the machine would be recycled at the end of its useful life . The cost of the recycling will be significant. Would this have an impact on the answer to part [a]: above ? Explain Caicuiate and compare depreciation under di'erent methods P9.4A {L0I 21Va1mont Limited purchased equipment on March 31 , 2021 , at a cost of $244,000 . Management is considering the merits of using the diminishing ha1ance or units -ofproduction method of depreciation instead of the straight line method , which it currently uses for other equipment .The new equipment has an estimated residual value of $4,000 and an estimated useful life of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts