Question: Bank A currently has $ 3 . 0 B in assets, with $ 2 . 5 8 B in deposits ( only liability ) and

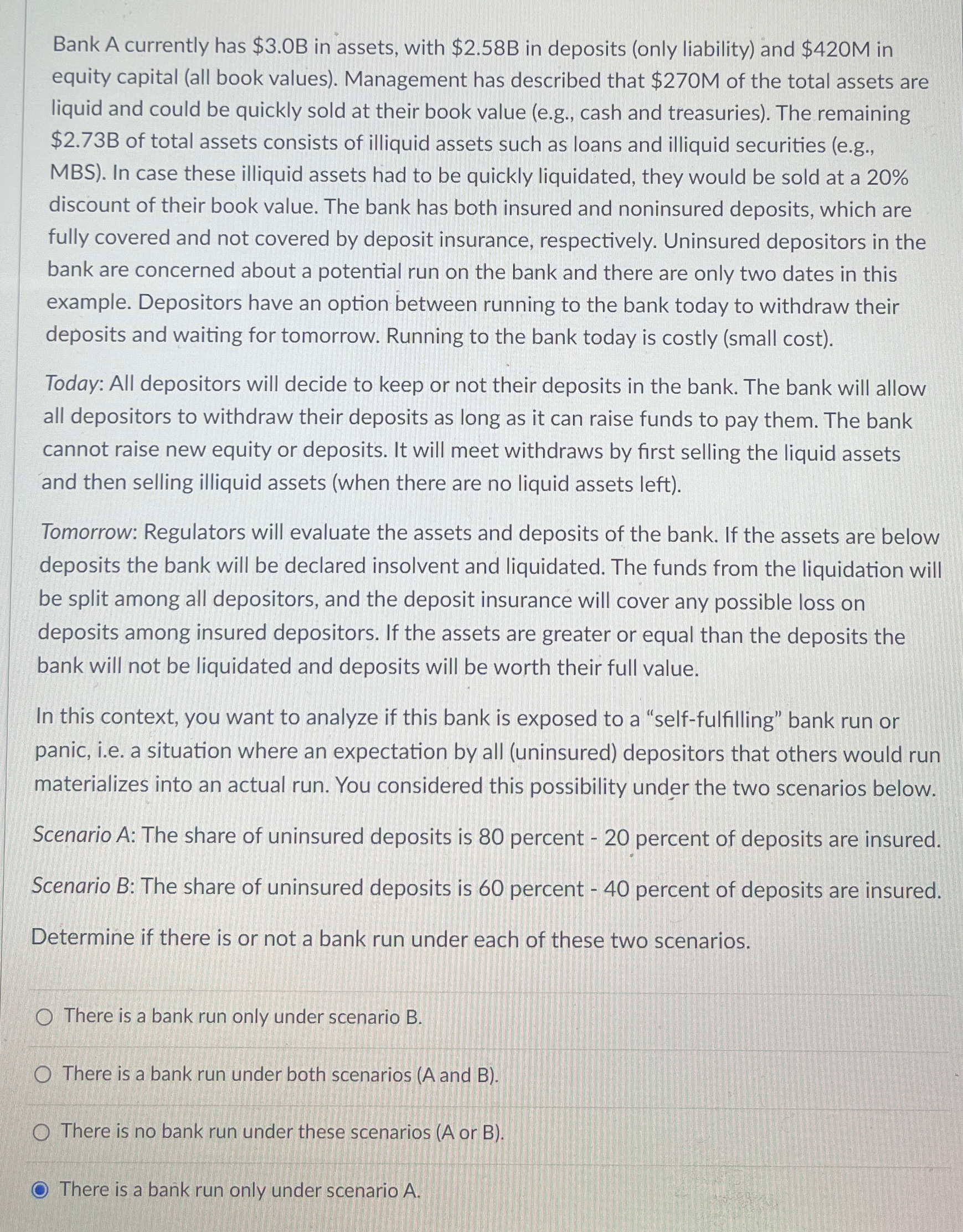

Bank A currently has $ in assets, with $ in deposits only liability and $ in equity capital all book values Management has described that $ of the total assets are liquid and could be quickly sold at their book value eg cash and treasuries The remaining $B of total assets consists of illiquid assets such as loans and illiquid securities eg MBS In case these illiquid assets had to be quickly liquidated, they would be sold at a discount of their book value. The bank has both insured and noninsured deposits, which are fully covered and not covered by deposit insurance, respectively. Uninsured depositors in the bank are concerned about a potential run on the bank and there are only two dates in this example. Depositors have an option between running to the bank today to withdraw their deposits and waiting for tomorrow. Running to the bank today is costly small cost

Today: All depositors will decide to keep or not their deposits in the bank. The bank will allow all depositors to withdraw their deposits as long as it can raise funds to pay them. The bank cannot raise new equity or deposits. It will meet withdraws by first selling the liquid assets and then selling illiquid assets when there are no liquid assets left

Tomorrow: Regulators will evaluate the assets and deposits of the bank. If the assets are below deposits the bank will be declared insolvent and liquidated. The funds from the liquidation will be split among all depositors, and the deposit insurance will cover any possible loss on deposits among insured depositors. If the assets are greater or equal than the deposits the bank will not be liquidated and deposits will be worth their full value.

In this context, you want to analyze if this bank is exposed to a "selffulfilling" bank run or panic, ie a situation where an expectation by all uninsured depositors that others would run materializes into an actual run. You considered this possibility under the two scenarios below.

Scenario A: The share of uninsured deposits is percent percent of deposits are insured.

Scenario B: The share of uninsured deposits is percent percent of deposits are insured.

Determine if there is or not a bank run under each of these two scenarios.

There is a bank run only under scenario

There is a bank run under both scenarios A and

There is no bank run under these scenarios A or B

There is a bank run only under scenario

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock