Question: Bank B 3.02% compounded continuously Bank C 2.95% compounded 4 times per year Bank D 3.00% compounded twice per year Question 4 Answer parts 1

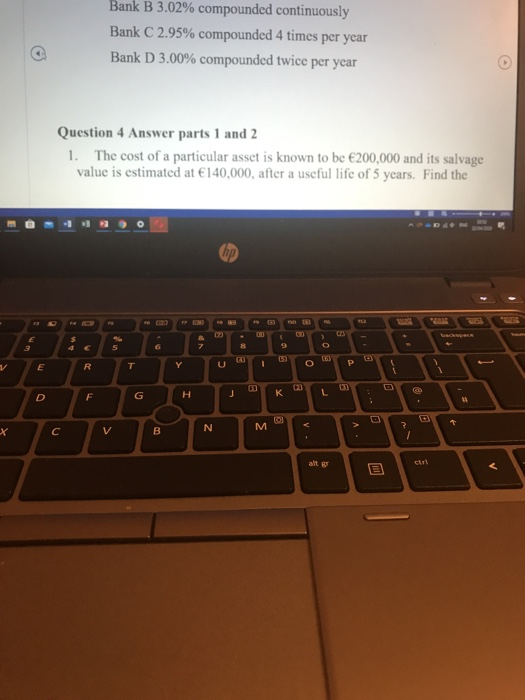

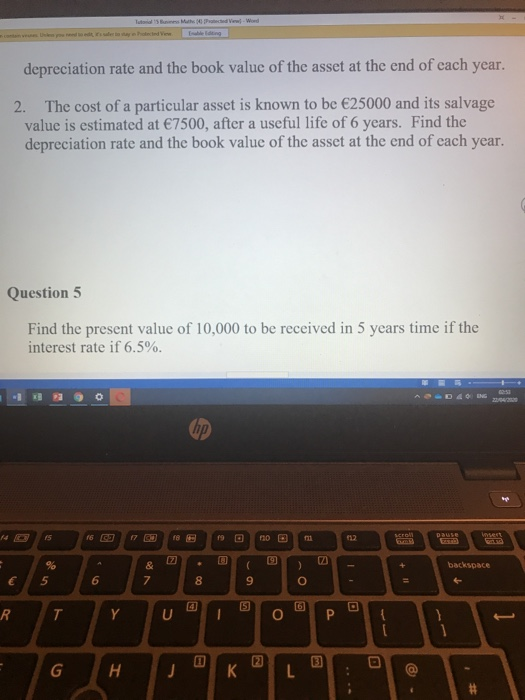

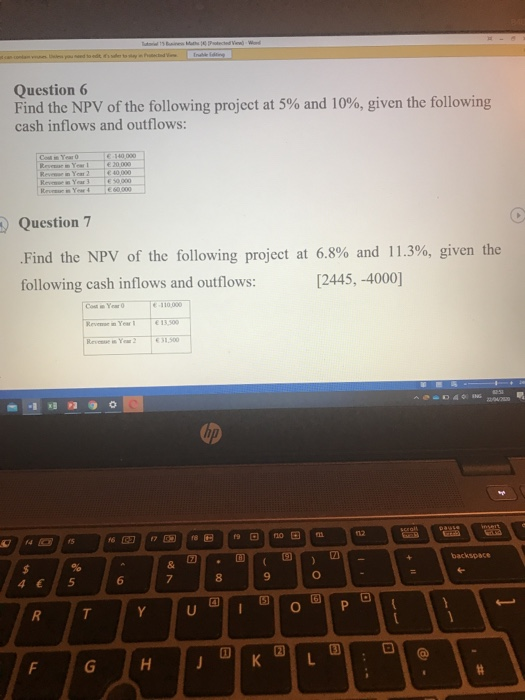

Bank B 3.02% compounded continuously Bank C 2.95% compounded 4 times per year Bank D 3.00% compounded twice per year Question 4 Answer parts 1 and 2 1. The cost of a particular asset is known to be 200,000 and its salvage value is estimated at 140,000, after a useful life of 5 years. Find the R depreciation rate and the book value of the asset at the end of each year. 2. The cost of a particular asset is known to be 25000 and its salvage value is estimated at 7500, after a useful life of 6 years. Find the depreciation rate and the book value of the asset at the end of each year. Question 5 Find the present value of 10,000 to be received in 5 years time if the interest rate if 6.5%. Poted View Question 6 Find the NPV of the following project at 5% and 10%, given the following cash inflows and outflows: Ce Year IEGO Question 7 Find the NPV of the following project at 6.8% and 11.3%, given the following cash inflows and outflows: [2445, -4000] Year 13.500 1,500 backBCE 7 8 9 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts