Question: Bank issues two loans. Each loan yields a return 9 with probability 0.5 and 3 otherwise. Probabilities of success of individual loans are independently and

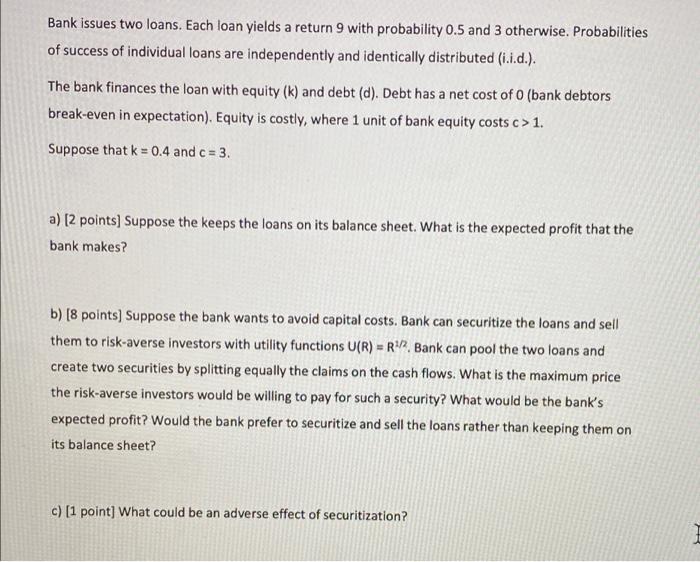

Bank issues two loans. Each loan yields a return 9 with probability 0.5 and 3 otherwise. Probabilities of success of individual loans are independently and identically distributed (i.i.d.). The bank finances the loan with equity (k) and debt (d). Debt has a net cost of (bank debtors break-even in expectation). Equity is costly, where 1 unit of bank equity costs c>1. Suppose that k = 0.4 and c = 3. a) [2 points] Suppose the keeps the loans on its balance sheet. What is the expected profit that the bank makes? b) [8 points) Suppose the bank wants to avoid capital costs. Bank can securitize the loans and sell them to risk-averse investors with utility functions U(R) = R1/2, Bank can pool the two loans and create two securities by splitting equally the claims on the cash flows. What is the maximum price the risk-averse investors would be willing to pay for such a security? What would be the bank's expected profit? Would the bank prefer to securitize and sell the loans rather than keeping them on its balance sheet? c) (1 point] What could be an adverse effect of securitization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts