Question: Bank Management (8th Edition) Chapter 7, Problem 4Q (2 Bookmarks) Show all steps ON Problem Suppose that your bank buys a T-bill yielding 4 percent

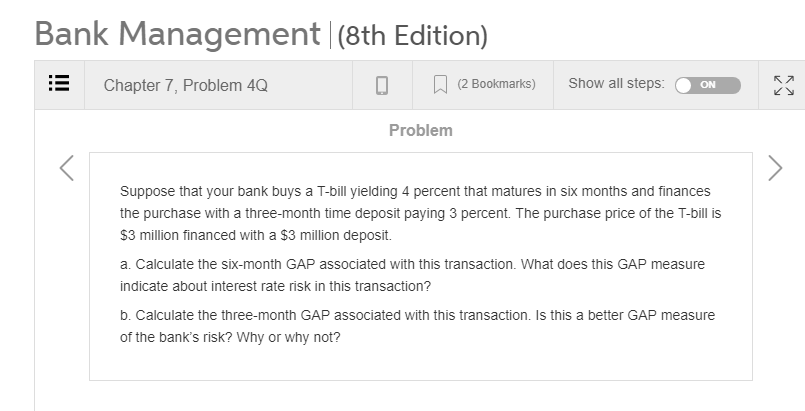

Bank Management (8th Edition) Chapter 7, Problem 4Q (2 Bookmarks) Show all steps ON Problem Suppose that your bank buys a T-bill yielding 4 percent that matures in six months and finances the purchase with a three-month time deposit paying 3 percent. The purchase price of the T-bill is $3 million financed with a $3 million deposit. a. Calculate the six-month GAP associated with this transaction. What does this GAP measure indicate about interest rate risk in this transaction? b. Calculate the three-month GAP associated with this transaction. Is this a better GAP measure of the bank's risk? Why or why not

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock