Question: Bank Management Chapter 2 Ratio Assignment: NAME: Using the Financial Statements attached, calculate the following ratios for 2017 and 2018 and comment on the change

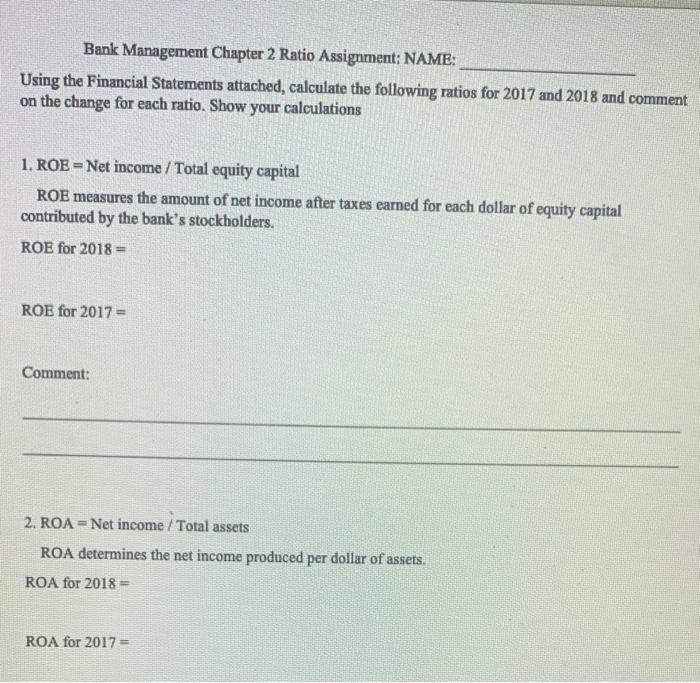

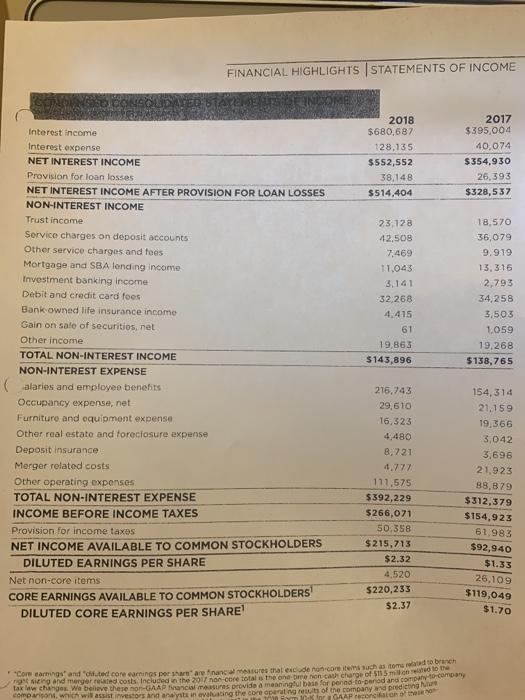

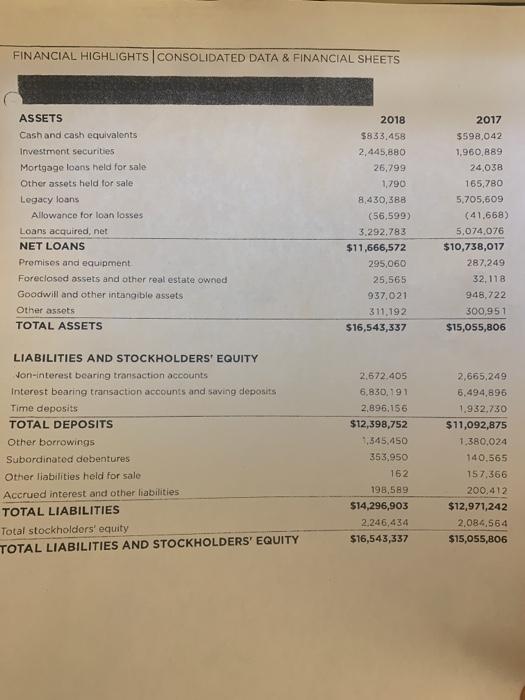

Bank Management Chapter 2 Ratio Assignment: NAME: Using the Financial Statements attached, calculate the following ratios for 2017 and 2018 and comment on the change for each ratio. Show your calculations 1. ROE = Net income / Total equity capital ROE measures the amount of net income after taxes earned for each dollar of equity capital contributed by the bank's stockholders. ROE for 2018 - ROE for 2017= Comment: 2. ROA = Net income / Total assets ROA determines the net income produced per dollar of assets. ROA for 2018 ROA for 2017= FINANCIAL HIGHLIGHTS STATEMENTS OF INCOME 2018 $680,687 128.135 $552,552 38,148 $514,404 2017 $395,004 40,074 $354,930 26,393 $328,537 23,128 42,508 7,469 11,043 3,141 32,268 4.415 61 19,863 $143,896 18,570 36,079 9.919 13,316 2,793 34,258 3,503 1,059 19,268 $138,765 Interest income Interest expense NET INTEREST INCOME Provision for loan losses NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES NON-INTEREST INCOME Trust income Service charges on deposit accounts Other service charges and fees Mortgage and SBA lending Income Investment banking income Debit and credit card foes Bank owned life insurance income Gain on sale of securitios.net Other income TOTAL NON-INTEREST INCOME NON-INTEREST EXPENSE alaries and employee benests Occupancy expense, net Furniture and equipment expense Other real estate and foreclosure expense Deposit insurance Merger related costs Other operating expenses TOTAL NON-INTEREST EXPENSE INCOME BEFORE INCOME TAXES Provision for income taxos NET INCOME AVAILABLE TO COMMON STOCKHOLDERS DILUTED EARNINGS PER SHARE Net non-core items CORE EARNINGS AVAILABLE TO COMMON STOCKHOLDERS DILUTED CORE EARNINGS PER SHARE 215,743 29,610 16,323 4,480 8,721 4.777 111.575 $392,229 $266,071 50.358 $215,713 $2.32 4,520 $220,233 52.37 154,314 21.159 19,366 3,042 3,696 21.923 88,879 $312,379 $154,923 61.983 $92,940 $1.33 26.109 $119,049 $1.70 Corearmas' and cittad core earnings per a financ mesures that ende non.com tema such as tombrie comorisont, with will assist investors and analysts in evaluating the core operating results of a company na predicting tax law changes. We believe there on GAAP sencial masures provide a meaningful basis for perindopriod and come to company no AAP reconciliation FINANCIAL HIGHLIGHTS CONSOLIDATED DATA & FINANCIAL SHEETS ASSETS Cash and cash equivalents Investment securities Mortgage loans held for sale Other assets held for sale Legacy loans Allowance for loan losses Loans acquired, net NET LOANS Premises and equipment Foreclosed assets and other real estate owned Goodwill and other intangible assets Other assets TOTAL ASSETS 2018 5833,458 2,445,880 26,799 1,790 8,430,388 (56,599) 3.292,783 $11,666,572 295,060 25,565 937,021 311.192 $16,543,337 2017 $598,042 1,960,889 24,038 165,780 5.705,609 (41.668) 5,074,076 $10,738,017 287,249 32,118 948,722 300,951 $15,055,806 2,665,249 LIABILITIES AND STOCKHOLDERS' EQUITY Jon-interest bearing transaction accounts Interest bearing transaction accounts and saving deposits Time deposits TOTAL DEPOSITS Other borrowings Subordinated debentures Other liabilities held for sale Accrued interest and other liabilities TOTAL LIABILITIES Total stockholders' equity TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 2.672 405 6,830, 191 2.896,156 $12,398,752 1,545,450 353,950 162 5.494,896 1.932,730 $11,092,875 1.380,024 140.565 157.366 200,412 $12,971,242 2,084,564 $15,055,806 195,589 $14,296,903 2,246,434 $16,543,337

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts