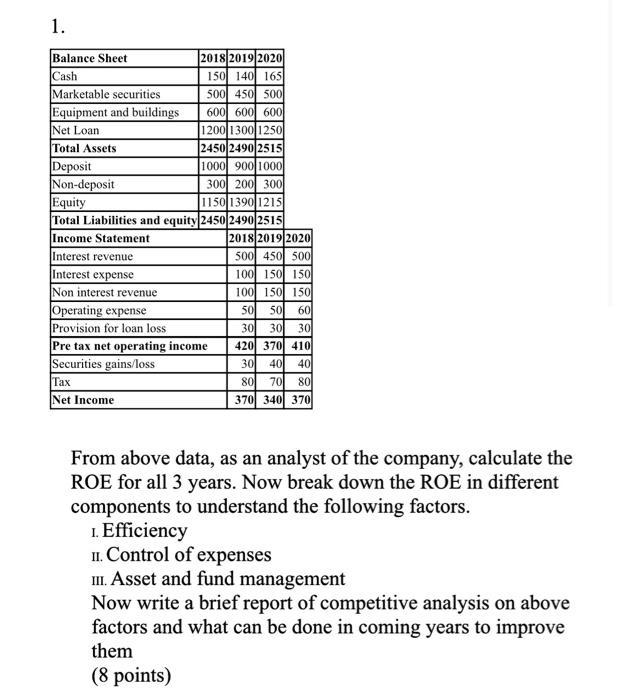

Question: Bank Management. Seeking expert's solution. Answer should be correct. 1. Balance Sheet 2018/2019/2020 Cash 150 140 1651 Marketable securities 500 450 500 Equipment and buildings

1. Balance Sheet 2018/2019/2020 Cash 150 140 1651 Marketable securities 500 450 500 Equipment and buildings 600 600 6001 Net Loan 1200 1300 1250 Total Assets 2450 2490 25151 Deposit 1000 900 1000 Non-deposit 300 200 300 Equity 1150139011215 Total Liabilities and equity 2450 2490 2515 Income Statement 2018 2019 2020 Interest revenue 500 450 5001 Interest expense 100 150 150 Non interest revenue 1001 1501 150l Operating expense 50 SO 60 Provision for loan loss 30 30 30 Pre tax net operating income 420 370 4101 Securities gains/loss 301 401 40 Tax 80 70 801 Net Income 370 340 3701 From above data, as an analyst of the company, calculate the ROE for all 3 years. Now break down the ROE in different components to understand the following factors. 1. Efficiency 11. Control of expenses III. Asset and fund management Now write a brief report of competitive analysis on above factors and what can be done in coming years to improve them (8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts