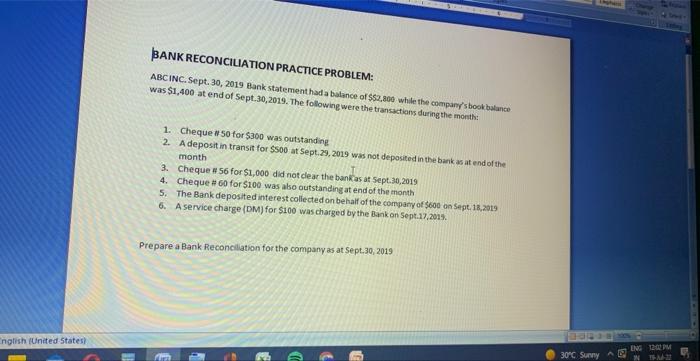

Question: BANK RECONCILIATION PRACTICE PROBLEM: ABCINC. Sept. 30,2019 Eank statement had a batance of $S2,800 while the company's book balanwo was $1,400 at end of 5ept.30,2019.

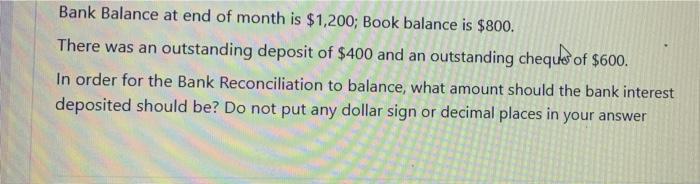

BANK RECONCILIATION PRACTICE PROBLEM: ABCINC. Sept. 30,2019 Eank statement had a batance of $S2,800 while the company's book balanwo was $1,400 at end of 5ept.30,2019. The following were the transactians during the month: 1. Cheque n50 for $300 was outstanding 2. A deposit in transit for $500 at Sept.29, 2019 was not deposited in the bank as at end of the month 3. Cheque 456 for $1,000 did not clear the bankras at Sept,30,2019 4. Cheque # 60 for $100 was also outstanding at end of the month 5. The Bank deposited interest colfected on behalf of the company of 3000 on Sept. 18,2019 6. A service charge (DM) for $100 was charged by the Bank on Sept.17,201\%. Prepare a Bank Reconcilation for the companyas at Sept, 30, 2019 Bank Balance at end of month is $1,200; Book balance is $800. There was an outstanding deposit of $400 and an outstanding cheques of $600. In order for the Bank Reconciliation to balance, what amount should the bank interest deposited should be? Do not put any dollar sign or decimal places in your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts