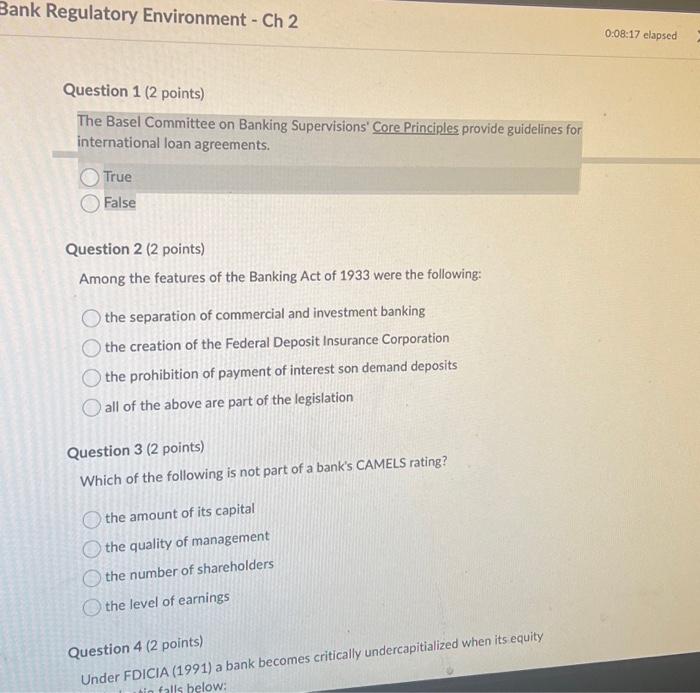

Question: Bank Regulatory Environment - Ch 2 Question 1 (2 points) The Basel Committee on Banking Supervisions' Core Principles provide guidelines for international loan agreements. True

The Basel Committee on Banking Supervisions' Core Principles provide guidelines for international loan agreements. True False Question 2 (2 points) Among the features of the Banking Act of 1933 were the following: the separation of commercial and investment banking the creation of the Federal Deposit Insurance Corporation the prohibition of payment of interest son demand deposits all of the above are part of the legislation Question 3 (2 points) Which of the following is not part of a bank's CAMELS rating? the amount of its capital the quality of management the number of shareholders the level of earnings Question 4 (2 points) Under FDICIA (1991) a bank becomes critically undercapitialized when its equity The Basel Committee on Banking Supervisions' Core Principles provide guidelines for international loan agreements. True False Question 2 (2 points) Among the features of the Banking Act of 1933 were the following: the separation of commercial and investment banking the creation of the Federal Deposit Insurance Corporation the prohibition of payment of interest son demand deposits all of the above are part of the legislation Question 3 (2 points) Which of the following is not part of a bank's CAMELS rating? the amount of its capital the quality of management the number of shareholders the level of earnings Question 4 (2 points) Under FDICIA (1991) a bank becomes critically undercapitialized when its equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts