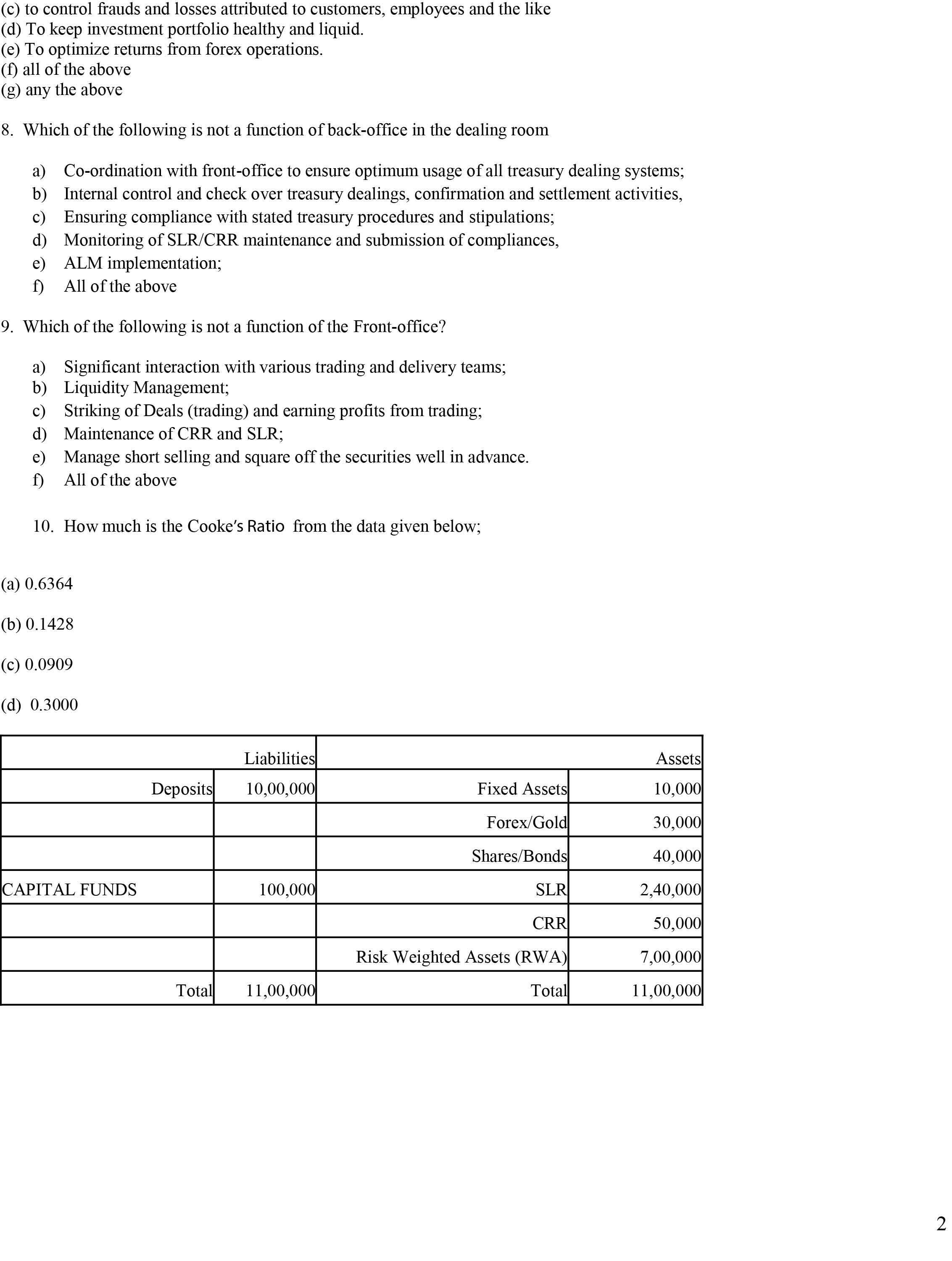

Question: BANKING OPERATIONS LAB QUIZ TEST FULL MARKS = 50 1. Savings Deposit account can be opened by banks in the name of ; a) Government

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts