Question: Banks securitize assets by combining debt instruments and standardizing them to increase their liquidity, lowering the cost of capital to borrowers and transferring the risk

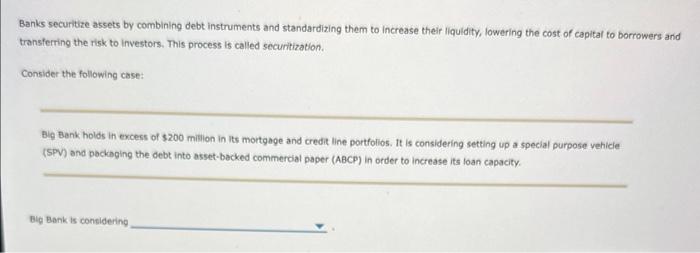

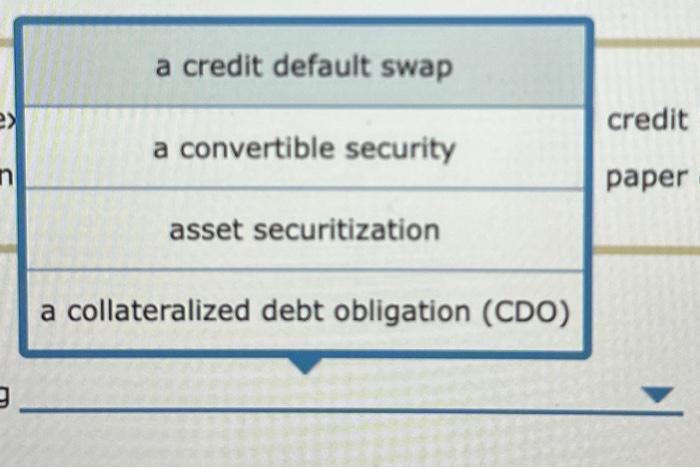

Banks securitize assets by combining debt instruments and standardizing them to increase their liquidity, lowering the cost of capital to borrowers and transferring the risk to investors. This process is called securitization. Consider the following case: Ble Bank holds in excess of $200 million in its mortgage and credit line portfolios. it is considering setting up a special purpose vehicie (SPV) and packoging the debt into asset-becked commercial paper (ABCP) in order to increase its loan capacity. \begin{tabular}{|c|} \hline a credit default swap \\ \hline a convertible security \\ a collateralized debt obligation (CDO) \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts