Question: Bard manufacturing uses a ms.ndus.edu Test 5: Part 1 (Chapter 19-worth 3c ICKINSON TATE UNIVERSITY my courses dickinson state resources resources kinson State University /(1830)

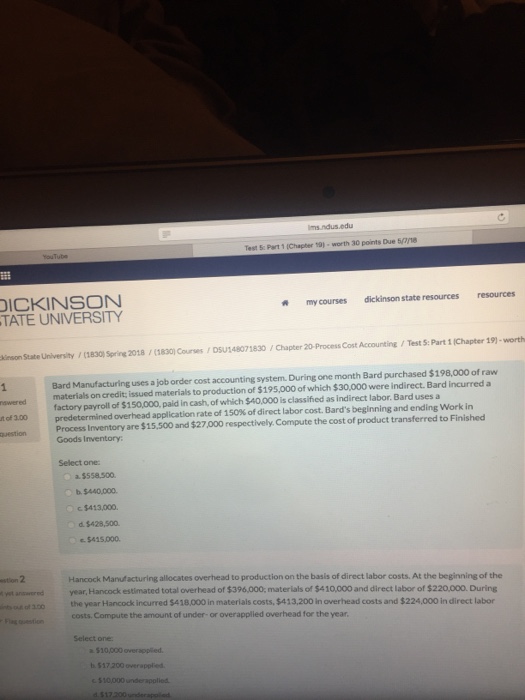

ms.ndus.edu Test 5: Part 1 (Chapter 19-worth 3c ICKINSON TATE UNIVERSITY my courses dickinson state resources resources kinson State University /(1830) Spring 2018/(1830) Courses /DSU148071830/Chapter 20-Process Cost Accounting/Test 5: Part 1 (Chapter 19)-worth Bard Manufacturing uses a job order cost accounting system. During one month Bard purchased $198,000 of raw materials on credit, issued materials to production of $195,000 of which $30,000 were indirect. Bard incurred a swered t of 300 uestion r. Bard uses a predetermined overhead application rate of 150% of direct labor cost. Bard's beginning and ending work in Process Inventory are $15,500 and $27,000 respectively. Compute the cost of product transferred to Finished Goods Inventory Select one a. 5558 500 b. $440,000. $413000. d. $428,500 $415.000. Hancock Manufacturing allocates overhead to production on the basis of direct labor costs. At the beginning of the year, Hancock estimated total overhead of $396.000, materials of $410,000 and direct labor of $220,000. During the year Hancock incurred $418,000 in materials costs, $413,200 in overhead costs and $224,000 in direct labor costs. Compute the amount of under- or overapplied overhead for the year estion 20o ear Select one b. $17 200 overapplied 510,000 underapplied

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts