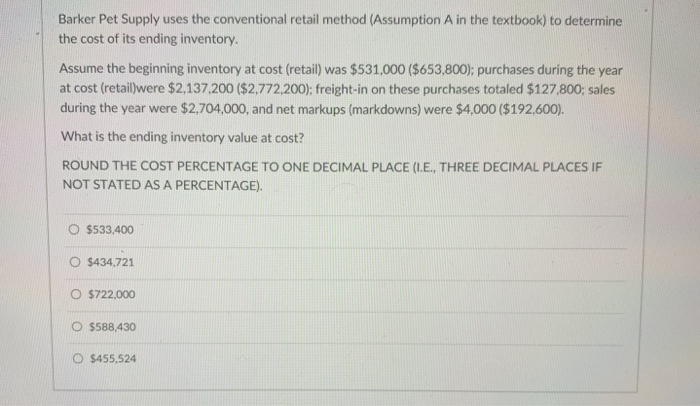

Question: Barker Pet Supply uses the conventional retail method (Assumption A in the textbook) to determine the cost of its ending inventory. Assume the beginning inventory

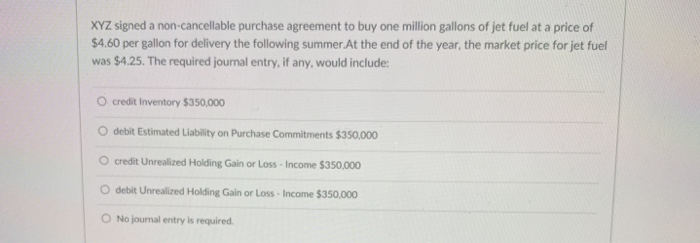

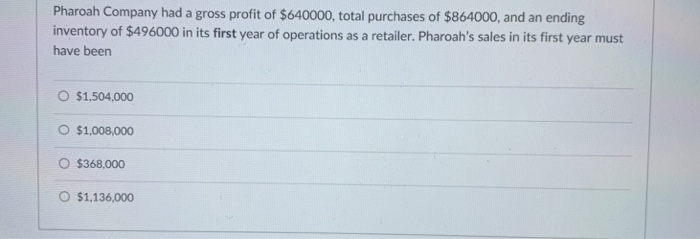

Barker Pet Supply uses the conventional retail method (Assumption A in the textbook) to determine the cost of its ending inventory. Assume the beginning inventory at cost (retail) was $531,000 ($653,800); purchases during the year at cost (retail)were $2,137.200 ($2,772.200); freight-in on these purchases totaled $127,800; sales during the year were $2,704,000, and net markups (markdowns) were $4,000 ($192,600). What is the ending inventory value at cost? ROUND THE COST PERCENTAGE TO ONE DECIMAL PLACE (I.E., THREE DECIMAL PLACES IF NOT STATED AS A PERCENTAGE). O $533,400 O $434,721 O $722,000 O $588.430 O $455,524 XYZ signed a non-cancellable purchase agreement to buy one million gallons of jet fuel at a price of $4.60 per gallon for delivery the following summer At the end of the year, the market price for jet fuel was $4.25. The required journal entry, if any, would include O credit Inventory $350.000 O debit Estimated Liability on Purchase Commitments $350,000 O credit Unrealized Holding Gain or Loss-Income $350,000 Odebit Unrealized Holding Gain or Loss Income $350,000 ONo journal entry is required Pharoah Company had a gross profit of $640000, total purchases of $864000, and an ending inventory of $496000 in its first year of operations as a retailer. Pharoah's sales in its first year must have been O $1,504,000 O $1,008,000 O $368,000 O $1,136,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts