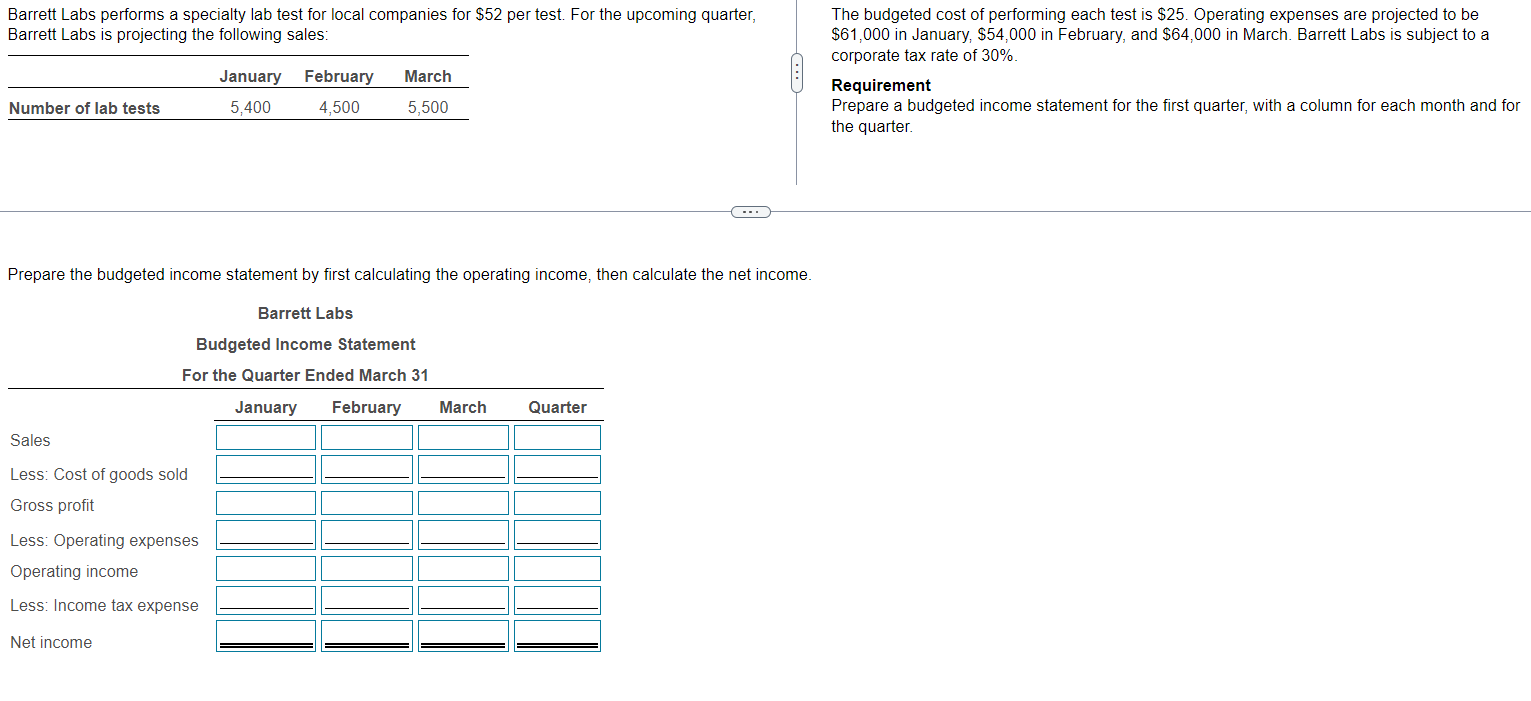

Question: Barrett Labs performs a specialty lab test for local companies for $52 per test. For the upcoming quarter, Barrett Labs is projecting the following sales:

Barrett Labs performs a specialty lab test for local companies for $52 per test. For the upcoming quarter, Barrett Labs is projecting the following sales: The budgeted cost of performing each test is $25. Operating expenses are projected to be $61,000 in January, $54,000 in February, and $64,000 in March. Barrett Labs is subject to a corporate tax rate of 30%. Requirement Prepare a budgeted income statement for the first quarter, with a column for each month and for the quarter. Prepare the budgeted income statement by first calculating the operating income, then calculate the net income. Barrett Labs performs a specialty lab test for local companies for $52 per test. For the upcoming quarter, Barrett Labs is projecting the following sales: The budgeted cost of performing each test is $25. Operating expenses are projected to be $61,000 in January, $54,000 in February, and $64,000 in March. Barrett Labs is subject to a corporate tax rate of 30%. Requirement Prepare a budgeted income statement for the first quarter, with a column for each month and for the quarter. Prepare the budgeted income statement by first calculating the operating income, then calculate the net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts