Question: Bart Problem 10-37 (LO. 2, 3, 4, 5, 7, 8) Bart and Elizabeth Forrest are married and have no dependents. They have asked you to

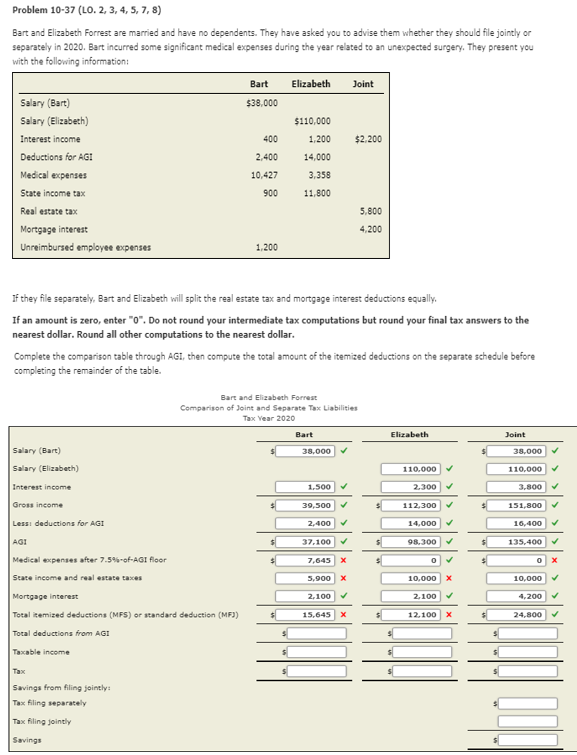

Bart Problem 10-37 (LO. 2, 3, 4, 5, 7, 8) Bart and Elizabeth Forrest are married and have no dependents. They have asked you to advise them whether they should file jointly or separately in 2020. Bart incurred some significant medical expenses during the year related to an unexpected surgery. They present you with the following information: Elizabeth Joint Salary (Bart) Salary (Elizabeth) $110,000 $2.200 Deductions for AGI 2.400 14,000 Medical expenses $38.000 Interest income 400 1.200 10.427 3,358 State income tax 900 11,800 5.800 Real estate tax Mortgage interest Unreimbursed employee expenses 4,200 1,200 If they file separately, Bart and Elizabeth will split the real estate tax and mortgage interest deductions equally. If an amount is zero, enter "o". Do not round your intermediate tax computations but round your final tax answers to the nearest dollar. Round all other computations to the nearest dollar. Complete the comparison table through AGI, then compute the total amount of the itemized deductions on the separate schedule before completing the remainder of the table. Bart and Elizabeth Forrest Comparison of Joint and Separate Tax Liabilities Tax Year 2020 Bart Elizabeth Joint 38.000 38,000 Salary (Bart) Salary (Elizabeth) 110.000 110.000 Interest income 1.500 2.300 3.800 Gross income 39,500 112.300 $ 151,800 2.400 14.000 16,400 37.100 5 98.300 $ 135.400 7,645 0 Less: deductions for AGI AGI Medical expenses after 7.5%-of-AGI floor Scare income and real estate taxes Mortgage interest Total itemized deductions (MFS) or standard deduction (MF)) Total deductions from AGI 5,900 10,000 X 10,000 2.100 2.100 4,200 15,645 $ 12.100 24,800 Taxable income Tax Savings from filing jointly: Tax filing separately Tax filing jointly Savings Bart Problem 10-37 (LO. 2, 3, 4, 5, 7, 8) Bart and Elizabeth Forrest are married and have no dependents. They have asked you to advise them whether they should file jointly or separately in 2020. Bart incurred some significant medical expenses during the year related to an unexpected surgery. They present you with the following information: Elizabeth Joint Salary (Bart) Salary (Elizabeth) $110,000 $2.200 Deductions for AGI 2.400 14,000 Medical expenses $38.000 Interest income 400 1.200 10.427 3,358 State income tax 900 11,800 5.800 Real estate tax Mortgage interest Unreimbursed employee expenses 4,200 1,200 If they file separately, Bart and Elizabeth will split the real estate tax and mortgage interest deductions equally. If an amount is zero, enter "o". Do not round your intermediate tax computations but round your final tax answers to the nearest dollar. Round all other computations to the nearest dollar. Complete the comparison table through AGI, then compute the total amount of the itemized deductions on the separate schedule before completing the remainder of the table. Bart and Elizabeth Forrest Comparison of Joint and Separate Tax Liabilities Tax Year 2020 Bart Elizabeth Joint 38.000 38,000 Salary (Bart) Salary (Elizabeth) 110.000 110.000 Interest income 1.500 2.300 3.800 Gross income 39,500 112.300 $ 151,800 2.400 14.000 16,400 37.100 5 98.300 $ 135.400 7,645 0 Less: deductions for AGI AGI Medical expenses after 7.5%-of-AGI floor Scare income and real estate taxes Mortgage interest Total itemized deductions (MFS) or standard deduction (MF)) Total deductions from AGI 5,900 10,000 X 10,000 2.100 2.100 4,200 15,645 $ 12.100 24,800 Taxable income Tax Savings from filing jointly: Tax filing separately Tax filing jointly Savings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts