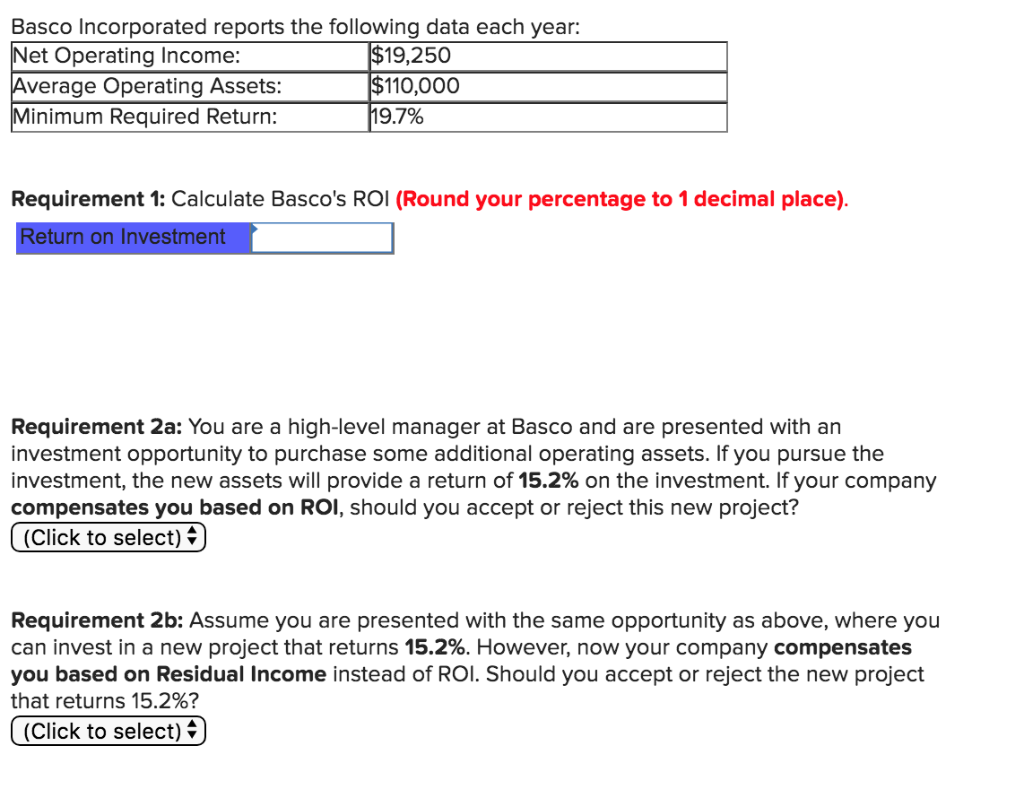

Question: Basco Incorporated reports the following data each year: Net Operating Income: Average Operating Assets: Minimum Required Return: $19,250 |$110,000 19.7% Requirement 1: Calculate Basco's ROI

Basco Incorporated reports the following data each year: Net Operating Income: Average Operating Assets: Minimum Required Return: $19,250 |$110,000 19.7% Requirement 1: Calculate Basco's ROI (Round your percentage to 1 decimal place) Return on Investment Requirement 2a: You are a high-level manager at Basco and are presented with an investment opportunity to purchase some additional operating assets. If you pursue the investment, the new assets will provide a return of 15.2% on the investment. If your company compensates you based on ROI, should you accept or reject this new project? (Click to select) Requirement 2b: Assume you are presented with the same opportunity as above, where you can invest in a new project that returns 15.2%. However, now your company compensates you based on Residual Income instead of ROI. Should you accept or reject the new project that returns 15.2%? (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts