Question: Base case Analysis: Assume 3 possible debt levels given in the case, as well as no debt. Debt will be used to repurchase shares at

Base case Analysis:

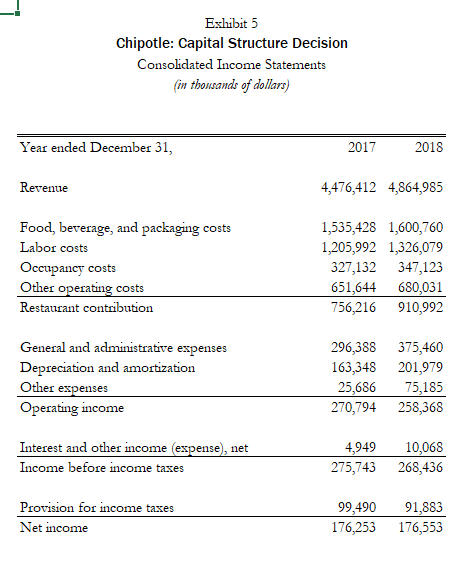

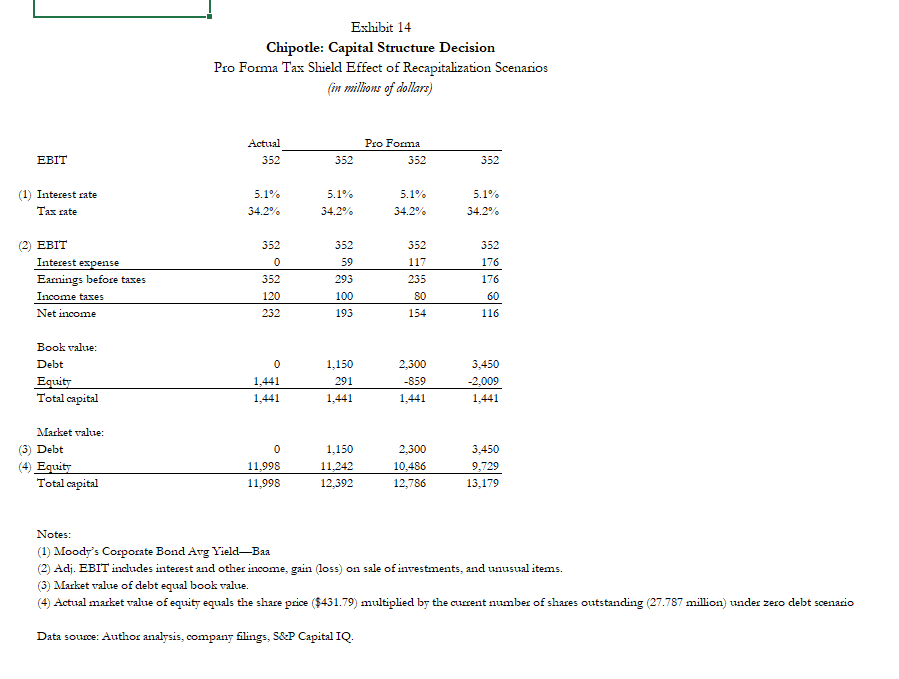

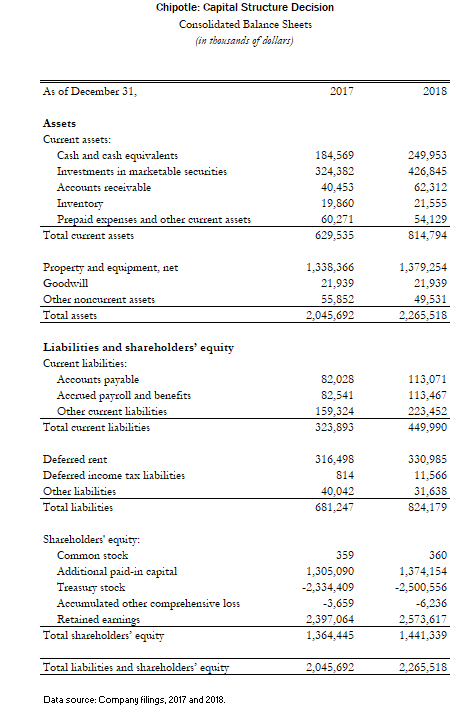

Assume 3 possible debt levels given in the case, as well as no debt. Debt will be used to repurchase shares at premiums of 5%, 10% and 20% to prevailing market price. In order to calculate resources available for share repurchases, start with net income using unadjusted EBIT then add depreciation and amortization. Assume existing cash in the balance sheet will not be used for share repurchases. Note that the student spreadsheet has been revised to use unadjusted EBIT for net income estimates (this assumes that there is no interest income for the existing 2018 cash balance). Please generate your own estimate of uses of resources. Assume no additional working capital requirements.

Calculate and explain movements in EPS, return on (book) equity, return on total (book) capital across the zero and three debt levels.

If needed, please assume that the share repurchase price will be the prevailing market price after repurchases are completed for simplicity (in MV equity estimations). Do not rely on Exhibit 4 of the student spreadsheet for market value and book value of total capital.

Exhibit 5 Chipotle: Capital Structure Decision Consolidated Income Statements (in thousands of dollars) Year ended December 31, Revenue Food, beverage, and packaging costs Labor costs Occupancy costs Other operating costs Restaurant contribution General and administrative expenses Depreciation and amortization Other expenses Operating income Interest and other income (expense), net Income before income taxes Provision for income taxes Net income 2017 2018 4,476,412 4,864,985 1,535,428 1,600,760 1,205,992 1,326,079 327,132 347,123 651,644 680,031 756,216 910,992 296,388 375,460 163,348 201,979 25,686 75,185 270,794 258,368 4,949 10,068 275,743 268,436 99,490 91,883 176,253 176,553 Exhibit 14 Chipotle: Capital Structure Decision Pro Forma Tax Shield Effect of Recapitalization Scenarios (in millions of dollars) Actual Pro Forma EBIT 352 352 352 (1) Interest rate 5.1% 5.1% 5.1% Tax rate 34.2% 34.2% 34.2% EBIT 352 352 352 Interest expense 0 59 117 Earnings before taxes 352 293 235 Income taxes 120 100 80 60 Net income 232 193 154 116 Book value: Debt 0 1,150 2,300 3,450 Equity 1,441 291 -859 -2,009 Total capital 1,441 1,441 1,441 1,441 Market value: 0 1,150 2,300 3,450 11,998 11,242 10,486 9,729 Total capital 11,998 12,392 12,786 13,179 Notes: (1) Moody's Corporate Bond Avg Yield-Baa (2) Adj. EBIT includes interest and other income, gain (loss) on sale of investments, and unusual items. (3) Market value of debt equal book value. (4) Actual market value of equity equals the share price ($431.79) multiplied by the current number of shares outstanding (27.787 million) under zero debt scenario Data source: Author analysis, company filings, S&P Capital IQ. (3) Debt (4) Equity 352 5.1% 34.2% 352 176 176 As of December 31, Assets Current assets: Chipotle: Capital Structure Decision Consolidated Balance Sheets (in thousands of dollars) Cash and cash equivalents Investments in marketable securities Accounts receivable Inventory Prepaid expenses and other current assets Total current assets Property and equipment, net Goodwill Other noncurrent assets Total assets Liabilities and shareholders' equity Current liabilities: Accounts payable Accrued payroll and benefits Other current liabilities Total current liabilities Deferred rent Deferred income tax liabilities Other liabilities Total liabilities Shareholders' equity: Common stock Additional paid-in capital Treasury stock Accumulated other comprehensive loss Retained earnings Total shareholders' equity Total liabilities and shareholders' equity Data source: Company filings, 2017 and 2018. 2017 184,569 324,382 40,453 19,860 60,271 629,535 1,338,366 21,939 55,852 2,045,692 82,028 82,541 159,324 323,893 316,498 814 40,042 681,247 359 1,305,090 -2,334,409 -3,659 2,397,064 1,364,445 2,045,692 2018 249,953 426,845 62,312 21,555 54,129 814,794 1,379,254 21,939 49,531 2,265,518 113,071 113,467 223,452 449,990 330,985 11,566 31,638 824,179 360 1,374,154 -2,500,556 -6,236 2,573,617 1,441,339 2,265,518

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts