Question: base? How is it determined? Q 11-6 Briefly differentiate between activity-based and time-based allocation methods. Q 11-7 Briefly differentiate between the straight-line depreciation meth and

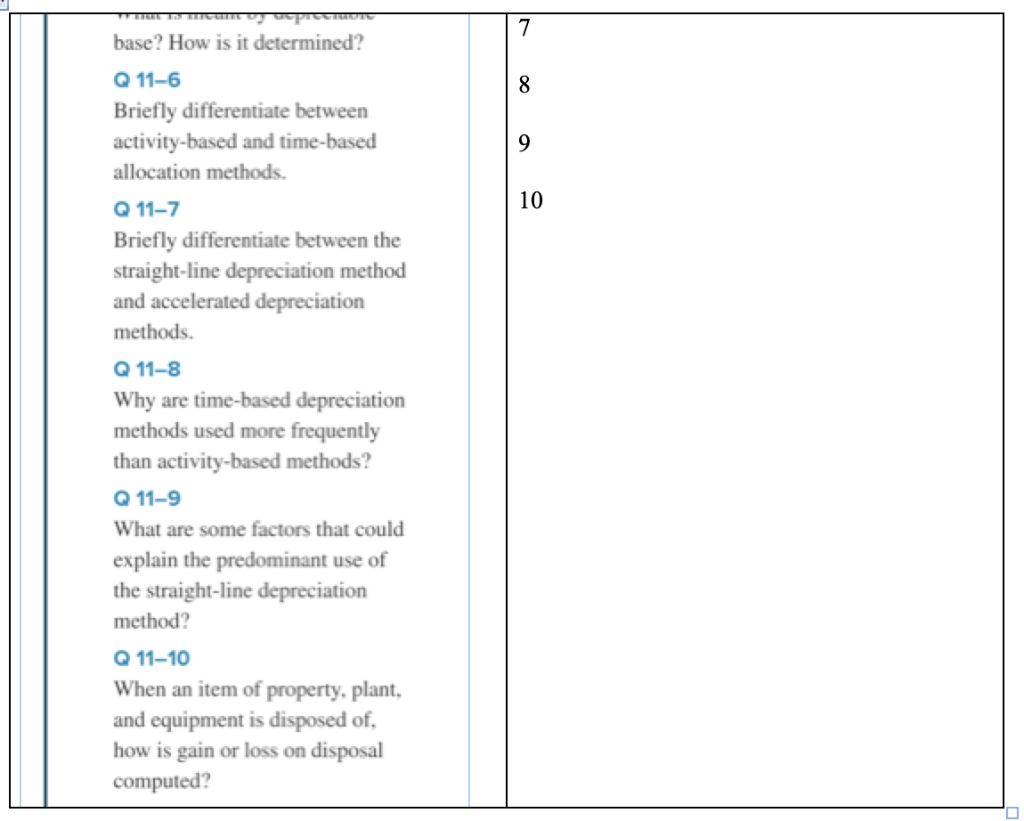

base? How is it determined? Q 11-6 Briefly differentiate between activity-based and time-based allocation methods. Q 11-7 Briefly differentiate between the straight-line depreciation meth and accelerated depreciation methods Q 11-8 Why are time-based depreciation methods used more frequently than activity-based methods? Q 11-9 What are some factors that coul explain the predominant use of the straight-line depreciation method? Q 11-10 When an item of property, plant, and equipment is disposed of, how computed? 10 od is gain or loss on disposal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts