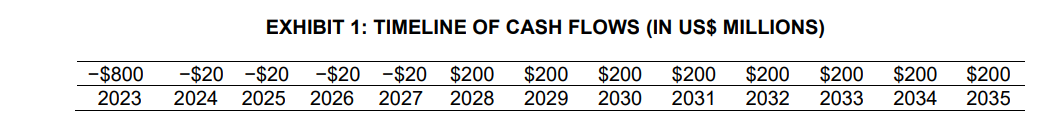

Question: Base model: project the cash flows for 2 0 2 3 2 0 3 5 and evaluate the investment decision by calculating the NPV ,

Base model: project the cash flows for and evaluate the investment decision by calculating the NPV payback period, IRR, and PIAssuming discount rate is consider the following possible outcomes and perform separate sensitivity analyses: First, if the Federal Reserve continued to raise interest rates in the aftertax cost of debt would be per cent. Second, Liz could issue a new year green bond catering to socially responsible investors who required relatively lower returns, which would result in an aftertax cost of debt of per cent for the project. Third, the European Union planned to implement the Carbon Border Adjustment Mechanism in which would give Lizs EVs with solidstate batteries a big advantage; the returns from the project could reach $ million each year Fourth, Liz could sell the technology to another automaker by the end of the th year for $ million. Fifth, if the technology turned out to be more valuable than expected, it could generate $ million annually from the fifth year and could be worth $ million in the market in Sixth, before investing in the project, Anthony expected that some other major automakers would use similar technology to enter the market by this would reduce Lizs expected returns to $ million annually. Seventh, if after Liz invested in the project in the first year, a competitor did enter the market, should Liz discontinue the project? If it were discontinued in the salvage value of selling the project to another automaker would be $ million at that time. Eighth, the market could accept the technology gradually; the return from the project in the fifth year would be $ million, and this would grow at per cent annually. Ninth, hydrogenpowered vehicles could have a breakthrough in technology and quickly dominate the market, driving out solidstate battery vehicles. With a probability of per cent, this possibility would shorten the life span of the project to years and completely wipe out the salvage value of the technology. Finally, the cash flows and the hurdle rate given above assumed the inflation rate was negligible. However, due to recent inflation hikes, Anthony wondered if she should incorporate an expected inflation rate of per cent in her analyses.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock