Question: Base on these ratios how can I conclude the position of S&S Air position vs the industry. Specially discuss a)short term solvency ratio b) asset

Base on these ratios how can I conclude the position of S&S Air position vs the industry. Specially discuss a)short term solvency ratio b) asset utilization ratio c) long term solvency ratio d) profitability ratio

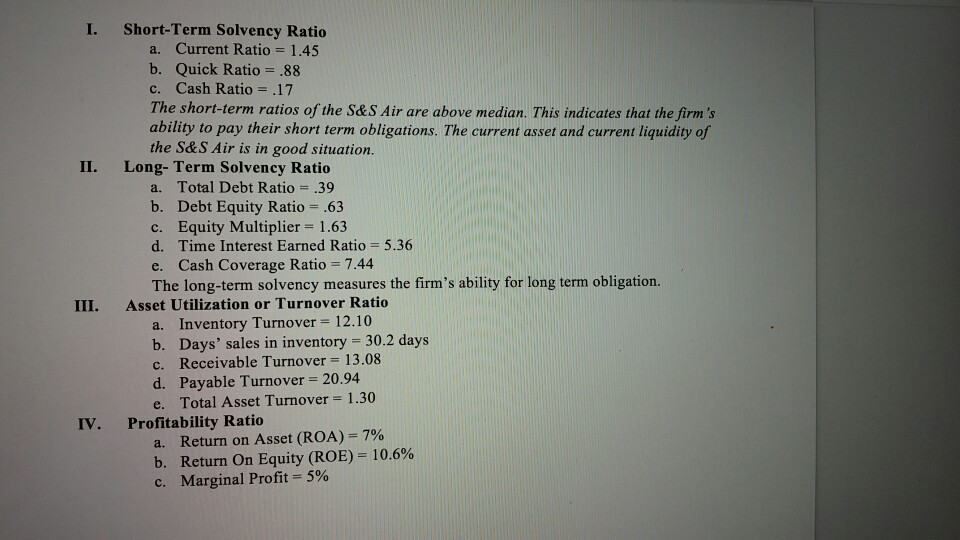

I. Short-Term Solvency Ratio a. Current Ratio= 1.45 b. Quick Ratio= .88 c. Cash Ratio=.17 The short-term ratios of the S& S Air are above median. This indicates that the firm's ability to pay their short term obligations. The current asset and current liquidity of the S&S Air is in good situation. II. Long- Term Solvency Ratio a. Total Debt Ratio .39 b. Debt Equity Ratio .63 c. Equity Multiplier 1.63 Time Interest Earned Ratio = 5.36 Cash Coverage Ratio = 7.44 d. e. Thelong term solverasymeaures he fs biyfon. III. Asset Utilization or Turnover Ratio a. Inventory Turnover 12.10 b. Days' sales in inventory 30.2 days c. Receivable Turnover 13.08 d. Payable Turnover -20.94 e. Total Asset Turnover 1.30 IV. Profitability Ratio a. Return on Asset (ROA)-7% b. Return On Equity (ROE) = 10.6% c, Marginal Profit 5% I. Short-Term Solvency Ratio a. Current Ratio= 1.45 b. Quick Ratio= .88 c. Cash Ratio=.17 The short-term ratios of the S& S Air are above median. This indicates that the firm's ability to pay their short term obligations. The current asset and current liquidity of the S&S Air is in good situation. II. Long- Term Solvency Ratio a. Total Debt Ratio .39 b. Debt Equity Ratio .63 c. Equity Multiplier 1.63 Time Interest Earned Ratio = 5.36 Cash Coverage Ratio = 7.44 d. e. Thelong term solverasymeaures he fs biyfon. III. Asset Utilization or Turnover Ratio a. Inventory Turnover 12.10 b. Days' sales in inventory 30.2 days c. Receivable Turnover 13.08 d. Payable Turnover -20.94 e. Total Asset Turnover 1.30 IV. Profitability Ratio a. Return on Asset (ROA)-7% b. Return On Equity (ROE) = 10.6% c, Marginal Profit 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts