Question: Based on the models given answer the questions. Model 1 estimates a regression of GDP on Invest, Govt, Exports, and Time. Model 2 Estimates the

Show transcribed image text?????

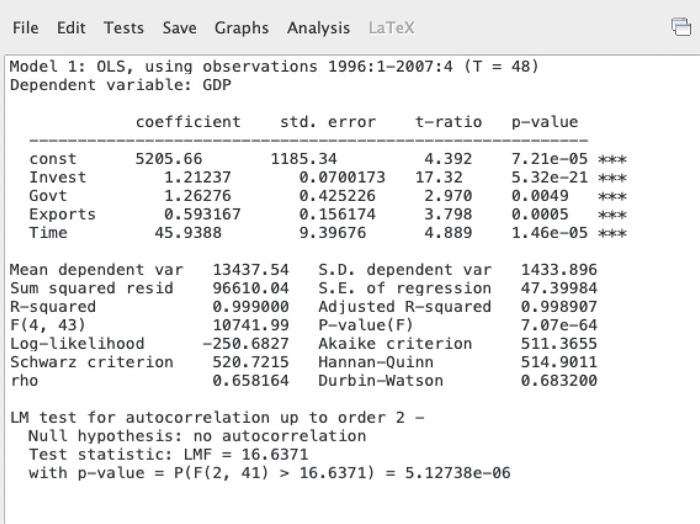

File Edit Tests Save Graphs Analysis LaTeX Model 1: OLS, using observations 1996:1-2007:4 (T = 48) Dependent variable: GDP const Invest Govt Exports Time coefficient 5205.66 1.21237 1.26276 0.593167 45.9388 Mean dependent var Sum squared resid R-squared F(4, 43) Log-likelihood Schwarz criterion rho std. error 1185.34 0.0700173 0.425226 0.156174 9.39676 520.7215 0.658164 t-ratio 4.392 17.32 2.970 3.798 4.889 13437.54 S.D. dependent var 96610.04 S.E. of regression 0.999000 Adjusted R-squared 10741.99 P-value (F) -250.6827 Akaike criterion Hannan-Quinn Durbin-Watson LM test for autocorrelation up to order 2 - Null hypothesis: no autocorrelation Test statistic: LMF = 16.6371 with p-value = P(F(2, 41) > 16.6371) = 5.12738e-06 p-value 7.21e-05 *** 5.32e-21 *** 0.0049 0.0005 ***** 1.46e-05 ***** **** 1433.896 47.39984 0.998907 7.07e-64 511.3655 514.9011 0.683200 D

Step by Step Solution

3.47 Rating (173 Votes )

There are 3 Steps involved in it

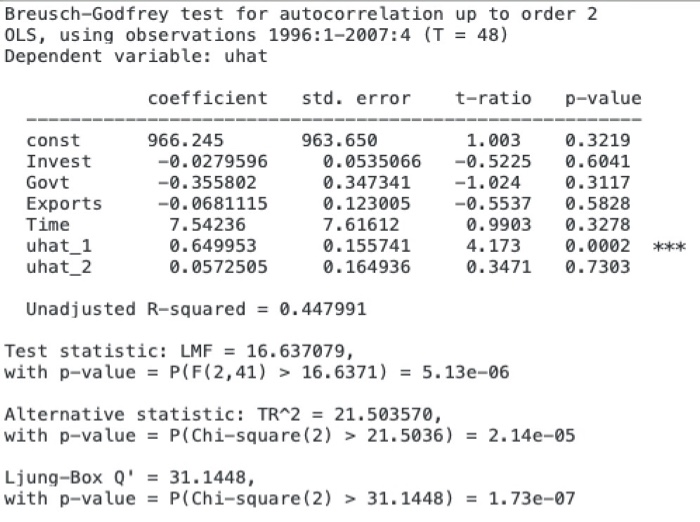

Question 9 Autocorrelation in Model 1 Conclusion on Autocorrelation BreuschGodfrey Test The pvalue f... View full answer

Get step-by-step solutions from verified subject matter experts