Question: Based off the financial information below... does this company appear financially healthy? What information can I determine about the company based off their statement? %

Based off the financial information below... does this company appear financially healthy? What information can I determine about the company based off their statement?

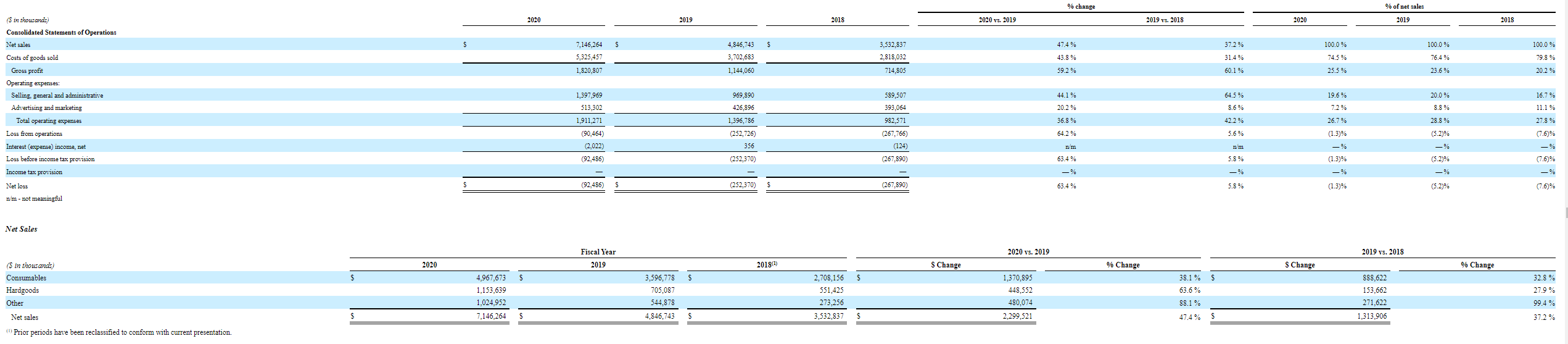

% change % of net sales 2020 2019 2018 2020 vs. 2019 2019 vs. 2018 2020 2019 2018 (S in thousands) Consolidated Statements of Operations Net sales $ S $ S 47.4% 37.2 % 100.0 % 7,146,264 5,325,457 1.820,807 4,846,743 3,702,683 1,144,060 3,532,837 2.818.032 100.0% 74.5% 100.0 % 76.4% 43.8% 31.4% 79.8% 714,805 59.2 % 60.1 % 25.5% 23.6 % 20.2% 44.1 % 64.5% 19.6% Costs of goods sold Gross profit Operating expenses: Selling, general and administrative Advertising and marketing Total operating expenses Loss from operations Interest (expense) income, net Loss before income tax provision 1,397,969 513,302 969,890 426,896 1,396,786 589,507 393,064 16.7 % 11.1% 20.2% 8.6% 20.0% 8.8% 28.8% 7.2% 36.8 % 42.2 % 26.7 % 27.8 % 64.2% 5.6% 1,911,271 (90.464) (2.022) (92,486) (252,726) 356 (252,370) 982,571 (267,766) (124) (267,890) mm nm (1.3)% - % (1.33% _% (5.2)% % (5.29% - % (7.6% - % (7.6% 63.4 % 5.8 % Income tax provision - % - % - % $ (92,486) (252,370) $ (267,890) 63.4 % 5.8% (1.3)% (5.2)% (7.6% Net loss n'm - not meaningful Net Sales 2020 vs. 2019 2019 vs. 2018 Fiscal Year 2019 2020 2018(1) $ Change % Change $ Change % Change $ $ S $ (S in thousands) Consumables Hardgoods Other 4,967,673 1,153,639 1,024.952 7,146,264 3,596,778 705,087 544.878 2,708,156 551,425 273,256 1,370,895 448,552 480.074 38.1 % 63.6% 88.1% 888,622 153,662 271,622 32.8% 27.9 % 99.4% 37.2% Net sales $ S 4,846,743 $ 3,532,837 S 2,299,521 47.4% $ 1,313.906 Prior periods have been reclassified to conform with current presentation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts