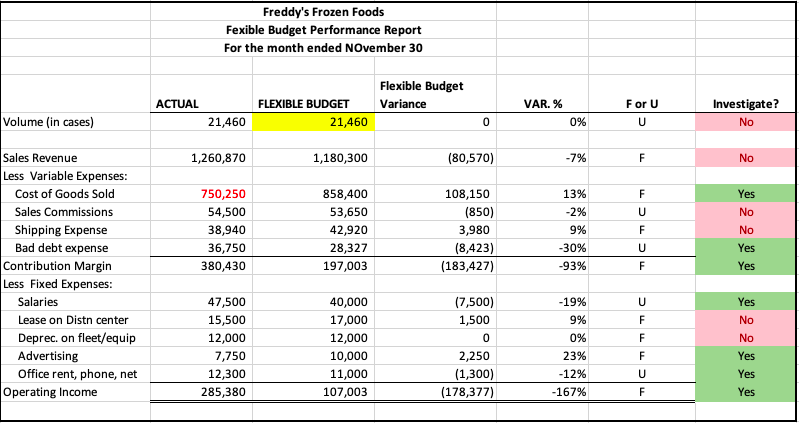

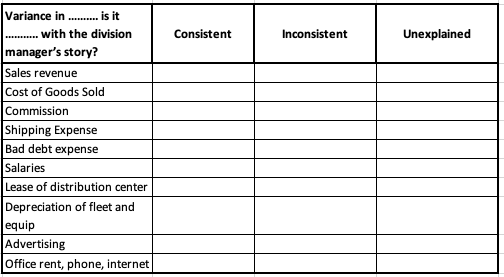

Question: Based on above number, need to analyze the empty columns: consistent - inconsistent - Unexplained. Freddy's Frozen Foods Fexible Budget Performance Report For the month

Based on above number, need to analyze the empty columns: consistent - inconsistent - Unexplained.

Freddy's Frozen Foods Fexible Budget Performance Report For the month ended November 30 Flexible Budget Variance ACTUAL FLEXIBLE BUDGET 21,460 VAR. % 0% For U U Investigate? No Volume (in cases) 21,460 0 1,260,870 1,180,300 (80,570) -7% F No 750,250 54,500 38,940 36,750 380,430 F U 858,400 53,650 42,920 28,327 197,003 108,150 (850) 3,980 (8,423) (183,427) 13% -2% 9% Yes No No Yes F U -30% -93% F Yes Sales Revenue Less Variable Expenses: Cost of Goods Sold Sales Commissions Shipping Expense Bad debt expense Contribution Margin Less Fixed Expenses: Salaries Lease on Distn center Deprec. on fleet/equip Advertising Office rent, phone, net Operating Income U Yes F F 47,500 15,500 12,000 7,750 12,300 285,380 40,000 17,000 12,000 10,000 11,000 107,003 (7,500) 1,500 0 2,250 (1,300) (178,377) -19% 9% 0% 23% -12% -167% F U F No No Yes Yes Yes Consistent Inconsistent Unexplained Variance in ......... is it ... with the division manager's story? Sales revenue Cost of Goods Sold Commission Shipping Expense Bad debt expense Salaries Lease of distribution center Depreciation of fleet and equip Advertising Office rent, phone, internet Freddy's Frozen Foods Fexible Budget Performance Report For the month ended November 30 Flexible Budget Variance ACTUAL FLEXIBLE BUDGET 21,460 VAR. % 0% For U U Investigate? No Volume (in cases) 21,460 0 1,260,870 1,180,300 (80,570) -7% F No 750,250 54,500 38,940 36,750 380,430 F U 858,400 53,650 42,920 28,327 197,003 108,150 (850) 3,980 (8,423) (183,427) 13% -2% 9% Yes No No Yes F U -30% -93% F Yes Sales Revenue Less Variable Expenses: Cost of Goods Sold Sales Commissions Shipping Expense Bad debt expense Contribution Margin Less Fixed Expenses: Salaries Lease on Distn center Deprec. on fleet/equip Advertising Office rent, phone, net Operating Income U Yes F F 47,500 15,500 12,000 7,750 12,300 285,380 40,000 17,000 12,000 10,000 11,000 107,003 (7,500) 1,500 0 2,250 (1,300) (178,377) -19% 9% 0% 23% -12% -167% F U F No No Yes Yes Yes Consistent Inconsistent Unexplained Variance in ......... is it ... with the division manager's story? Sales revenue Cost of Goods Sold Commission Shipping Expense Bad debt expense Salaries Lease of distribution center Depreciation of fleet and equip Advertising Office rent, phone, internet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts