Question: Based on Canada, answer me step by step. please Mr Jacob Johnson has net employment income of $53000 (after the deduction of $6000 in RPP

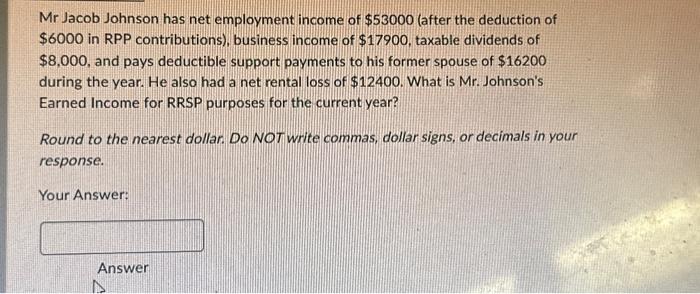

Mr Jacob Johnson has net employment income of $53000 (after the deduction of $6000 in RPP contributions), business income of $17900, taxable dividends of $8,000, and pays deductible support payments to his former spouse of $16200 during the year. He also had a net rental loss of $12400. What is Mr. Johnson's Earned Income for RRSP purposes for the current year? Round to the nearest dollar. Do NOT write commas, dollar signs, or decimals in your response. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts