Question: Based on conversations with a friend, Grace is considering selling the $100,000 of ABC stock and acquire $100,000 of XYZ stock instead, which has the

Based on conversations with a friend, Grace is considering selling the $100,000 of ABC stock and acquire $100,000 of XYZ stock instead, which has the same expected return and standard deviation of ABC stock. Her friend comments: It does not matter whether you keep all of the ABC stock or replace it with $100,000 of XYZ stock. Comment whether her friends comment is correct. Explain your answer.

Based on conversations with a friend, Grace is considering selling the $100,000 of ABC stock and acquire $100,000 of XYZ stock instead, which has the same expected return and standard deviation of ABC stock. Her friend comments: It does not matter whether you keep all of the ABC stock or replace it with $100,000 of XYZ stock. Comment whether her friends comment is correct. Explain your answer.

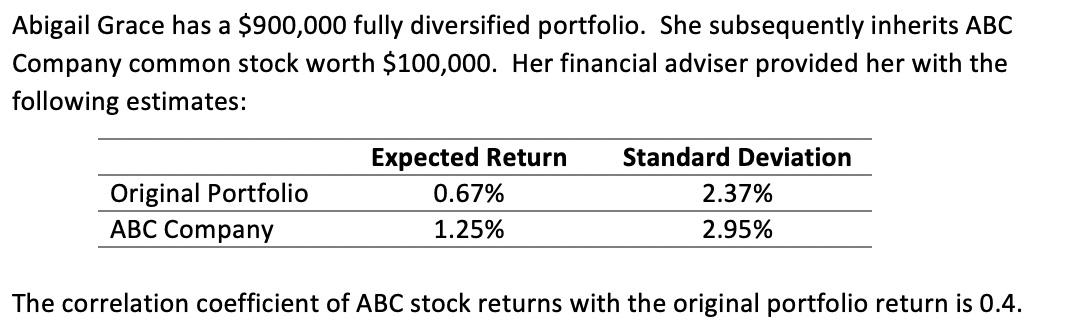

Abigail Grace has a $900,000 fully diversified portfolio. She subsequently inherits ABC Company common stock worth $100,000. Her financial adviser provided her with the following estimates: Original Portfolio ABC Company Expected Return 0.67% 1.25% Standard Deviation 2.37% 2.95% The correlation coefficient of ABC stock returns with the original portfolio return is 0.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts