Question: Based on Exhibits 2 and 3 and using Method 1, the amount (in absolute terms) by which the Hutto- Barkley corporate bond is mispriced is

Based on Exhibits 2 and 3 and using Method 1, the amount (in absolute terms)

by which the Hutto- Barkley corporate bond is mispriced is closest to:

| 0.3368 per 100 of par value.

| ||

| 0.4682 per 100 of par value. | ||

| 0.5156 per 100 of par value.

| ||

| 0.5556 per 100 of par value.

|

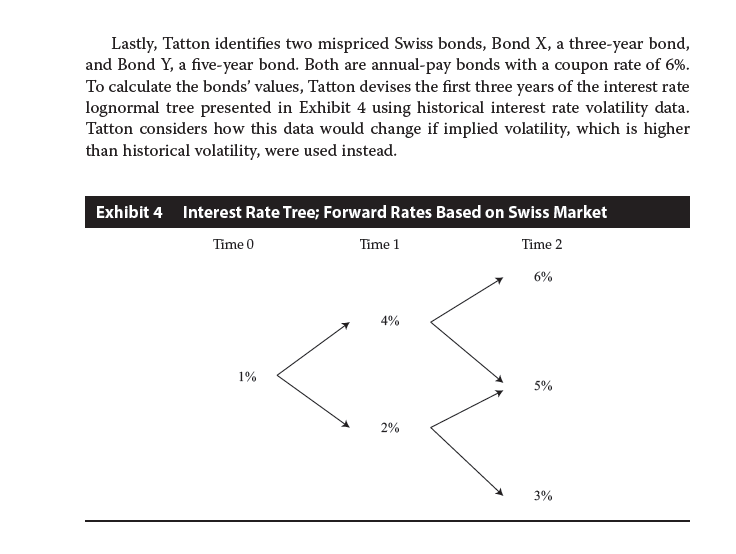

Lastly, Tatton identifies two mispriced Swiss bonds, Bond X, a three-year bond, and Bond Y, a five-year bond. Both are annual-pay bonds with a coupon rate of 6%. To calculate the bonds' values, Tatton devises the first three years of the interest rate lognormal tree presented in Exhibit 4 using historical interest rate volatility data. Tatton considers how this data would change if implied volatility, which is higher than historical volatility, were used instead. Exhibit 4 Interest Rate Tree; Forward Rates Based on Swiss Market Time 0 Time 2 6% 1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts