Question: Based on feedback you received last week, finalize the Sevilles' tax returns. Write a 4-page letter to Vanessa and Enrique Sevilla that: to. Describe to

Based on feedback you received last week, finalize the Sevilles' tax returns. Write a 4-page letter to Vanessa and Enrique Sevilla that:

to. Describe to clients the items on their current year tax return.

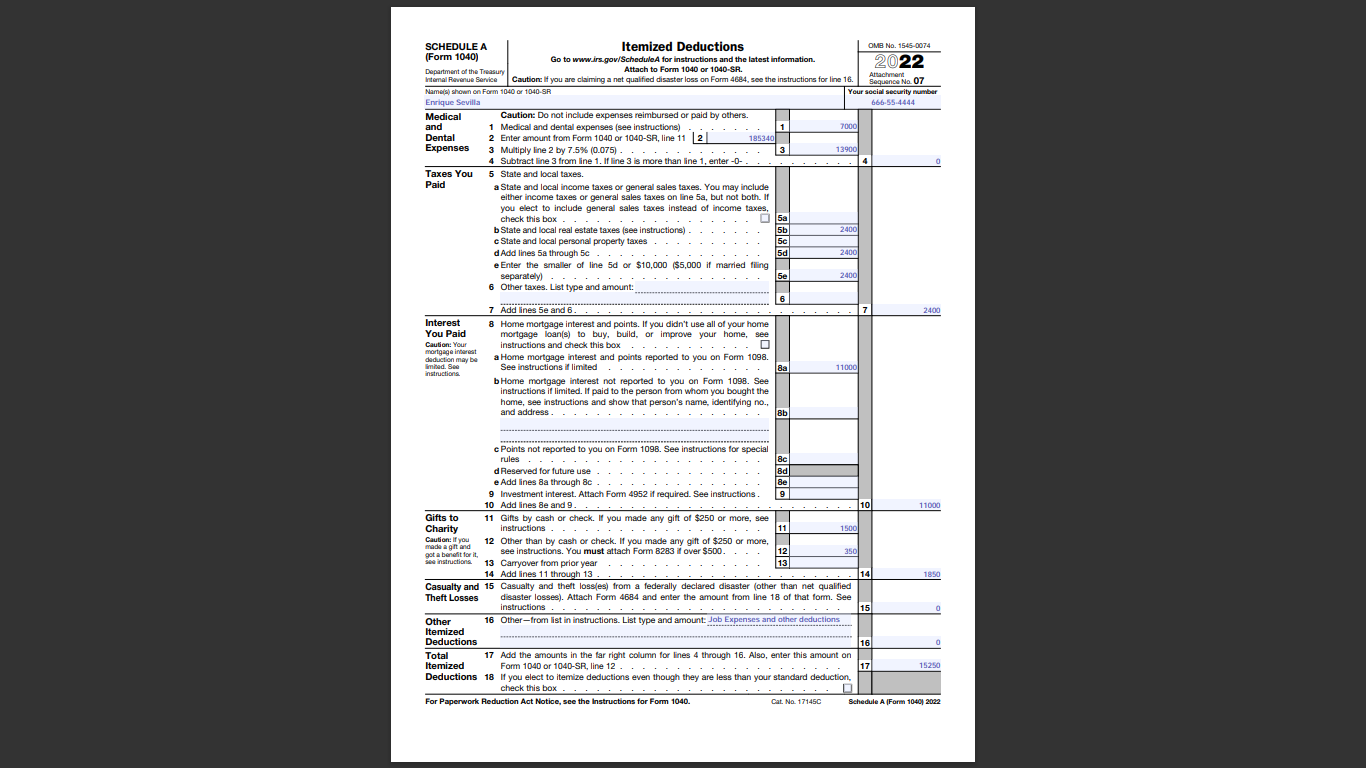

i. Detail what expenses you incurred that were not deductible for tax purposes and explain why. The Sevillas have always itemized deductions rather than taking the standard deduction on their tax return.

Explain how this may no longer be the best tax strategy due to changes in tax law under the TCJA.

ii. Regarding the investment opportunities you calculated in week 1, explain: 1. What investment opportunity would you recommend. 2. What is the conversion tax planning strategy and which of these investments employ this strategy. 3. How "implicit taxes" can limit the benefits of the conversion strategy.

iii. Vanessa and Enrique are considering buying a vacation home. They plan to spend several months each year vacationing at the house and rent the property the rest of the year. Provide an overview of the key tax considerations they should take into account when making this decision.

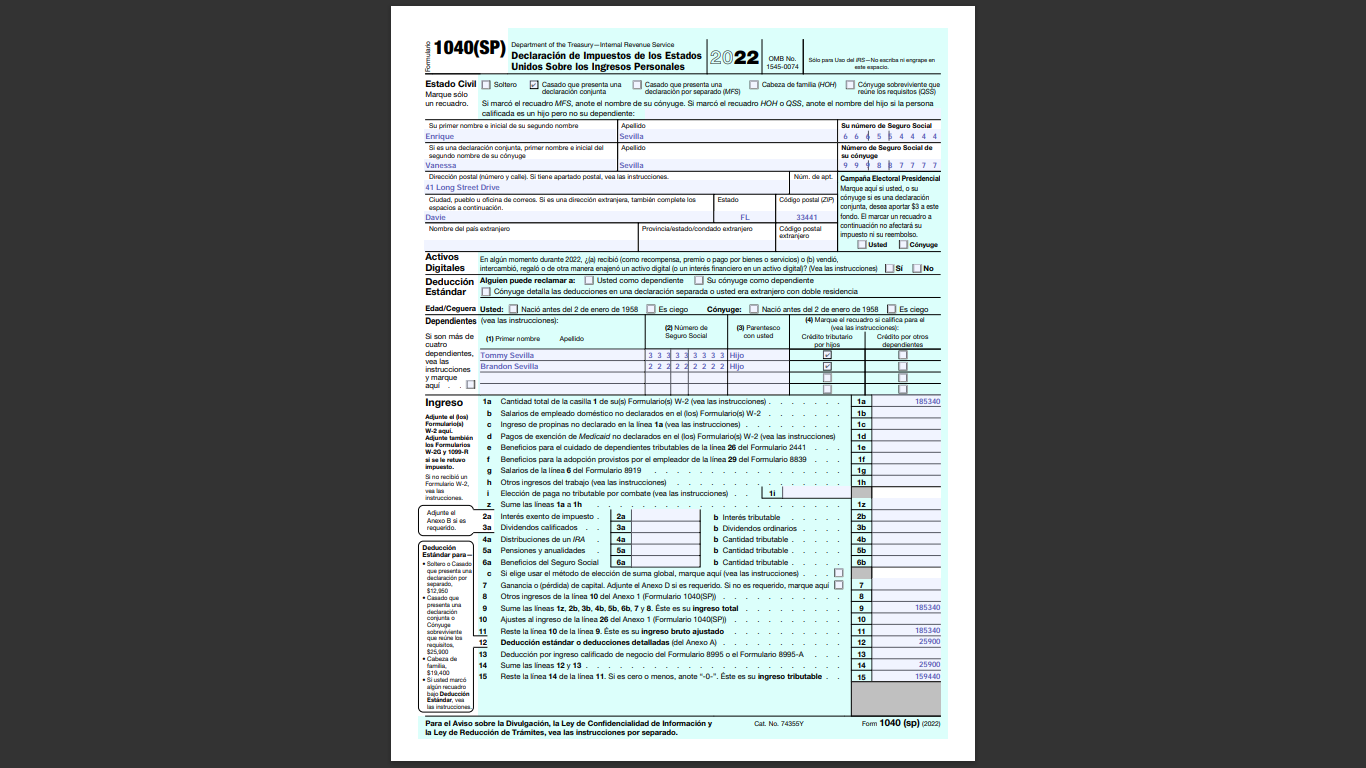

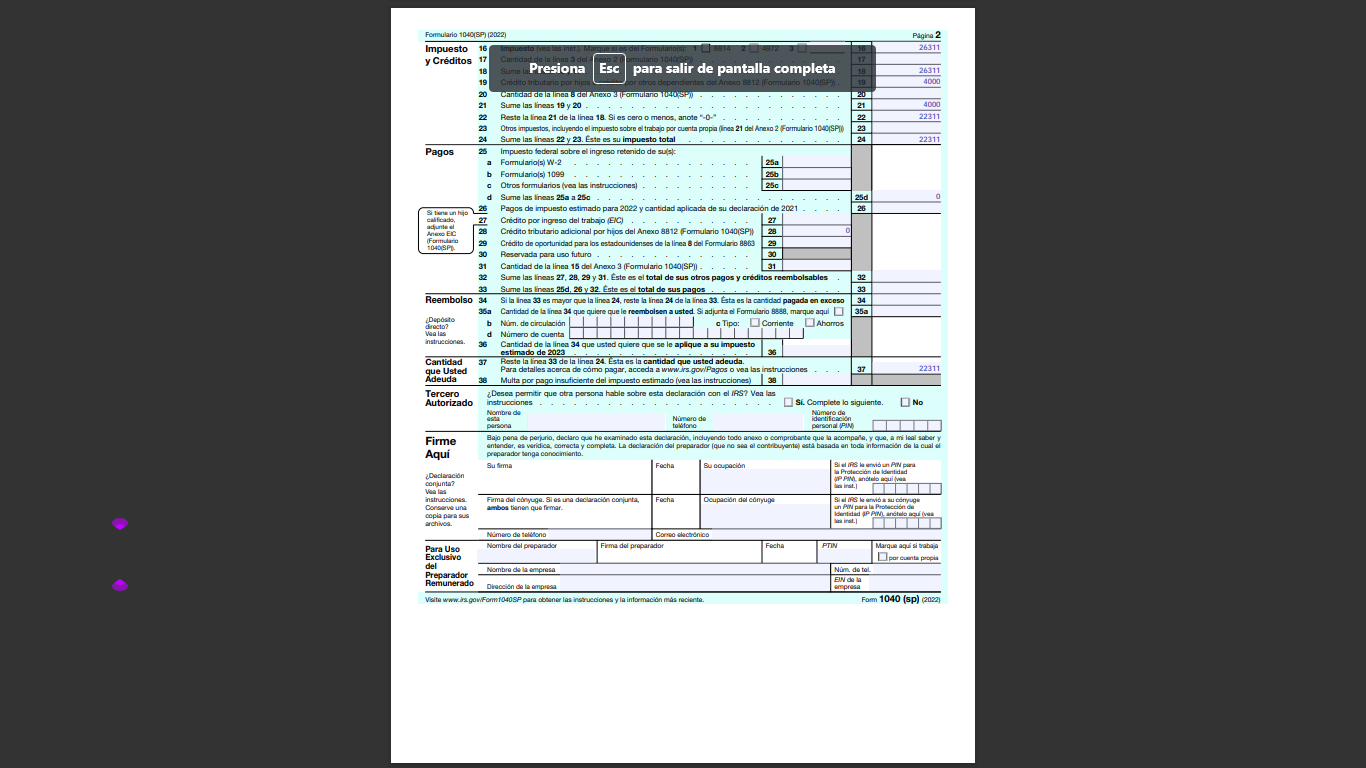

This is the information that was used to make Form 1040 and Schedule A.

Personal Information for Income Tax Preparation

We are at the end of the fiscal year, and Vanessa and Enrique Sevilla need your help in preparing the "Form 1040" and the "Schedule A" form.

Vanessa Sevilla, social security number (SS # 999-88-7777) Enrique Sevilla, social security number (SS# 666-55-4444) Address: 41 Long Street Drive Davie, FL 33441 The age and marital status of the taxpayers is: 52 years old, filing jointly, with two minor children: ? Tommy Sevilla (SS # 333-33-3333) ? Brandon Sevilla (SS# 222-22-2222)

For this problem, the gross income is $185,340

This year, Vanessa got a new job, and the whole family moved to another city. The new job is located in the same State, but 700 miles farther from the house where they lived before moving. Before moving, the family took some time finding the new house and in this housing search process they incurred costs of $800. They hired a moving service company to whom they paid $2,700. On the way to their new house, they spent $70 on meals and $98 on a hotel room. They also stopped at an amusement park and spent $100 on admission tickets. The Sevillas paid $11,000 in interest on the mortgage loan on their home during the year and $2,400 in property taxes on their new home. They also paid $1,200 in interest on his personal credit card and Vanessa paid $900 in interest on her educational loan. Enrique was hospitalized this year for heart problems, which required surgery. The Sevillas incurred $26,000 in medical expenses as a result of Enrique's illness. Of this amount, $19,000 was reimbursed by the insurance company. During the year, the Sevillas contributed $1,500 in cash to the Salvation Army. Before moving into the new house, the Sevillas donated clothing and furniture to the Breast Cancer Foundation, for which they had paid $700. At the time of donation, the value of the donated items was $350. They also donated baby furniture to their friends, which was valued at $200. Enrique paid $250 in union fees this year and the family paid $200 for tax return preparation.

Attached is Form 1040 and Schedule A.

\f\fSCHEDULE A Itemized Deductions OMB No. 1545-0074 (Form 1040) Go to www.irs.gov/ScheduleA for instructions and the latest information. 2022 Department of the Treasury Attach to Form 1040 or 1040-SR. Revenue Service Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16. machmant Soquance No. 07 Name(s) shown on Form 1040 or 1040-8F Your social security number Enrique Sevilla 664.65.4484 Medical Caution: Do not include expenses reimbursed or paid by others. and 1 Medical and dental exp es (see instructions) 1 7000 Dental 2 Enter amount from Form 1040 or 1040-SR, line 11 2| 185340 Expenses 3 Multiply line 2 by 7.5% (0.075) . . 13 13900 4 Subtract line 3 from line 1. If line 3 is more than line 1, ente Taxes You 5 State and local taxes. Paid a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales tax es instead of income taxes, check this box . b State and local real estate taxes (see instructions) . c State and local personal property taxes d Add lines 5a through 5c . Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately). 2400 6 Other taxes. List type and amount: 7 Add lines 5e and 6 7 2400 Interest B Home mortgage interest and points. If you didn't use all of your home You Paid mortgage loan(s) to buy, build, or improve your home, see Caution: Your instructions and check this box 0 mortgage intan in deduction may be a Home mortgage interest and points reported to you on Form 1098. See instructions if limited instructions - . 8a 11000 b Home mortgage interest not reported to you on Form 1098. See instructions if limited. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address . Bb c Points not reported to you on Form 1098. S or special rules d Reserved for future use e Add lines Ba through ac . Be 9 Investment interest. Attach Form 4952 if required. See instructions . 10 Add lines Be and 9. 10 11000 Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, see Charity instructions . 11 Caution: If you made a gift and 12 Other than by cash or check. If you made any gift of $250 or more, at a benefit for it, see instructions. You must attach Form 8283 if over $500. 12 God instructions 13 Carryover from prior year 13 14 Add lines 11 through 13 . 14 1850 Casualty and 15 Casualty and theft losses) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions . 15 Other 16 Other-from list in instr type and amount: Job Itemized Deductions 16 Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040 or 1040-SR, line 12 . 17 15250 Deductions 18 If you elect to itemize deductions even though they are less than your standard deduction. check this box . For Paperwork Reduction Act Notice, see the Instructions for Form 1040. Cat. No. 17145C Schedule A [Form 1040) 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts