Question: Based on information given in question 1, If inflation rate is 1%, how much is real interest rate? If expected inflation rate increased to 6%,

Based on information given in question 1, If inflation rate is 1%, how much is real interest rate? If expected inflation rate increased to 6%, how much is 3 month T bill interest rate? 20 year Treasury Bond interest rate? 20 Year AT & T corporate bond interest rate?

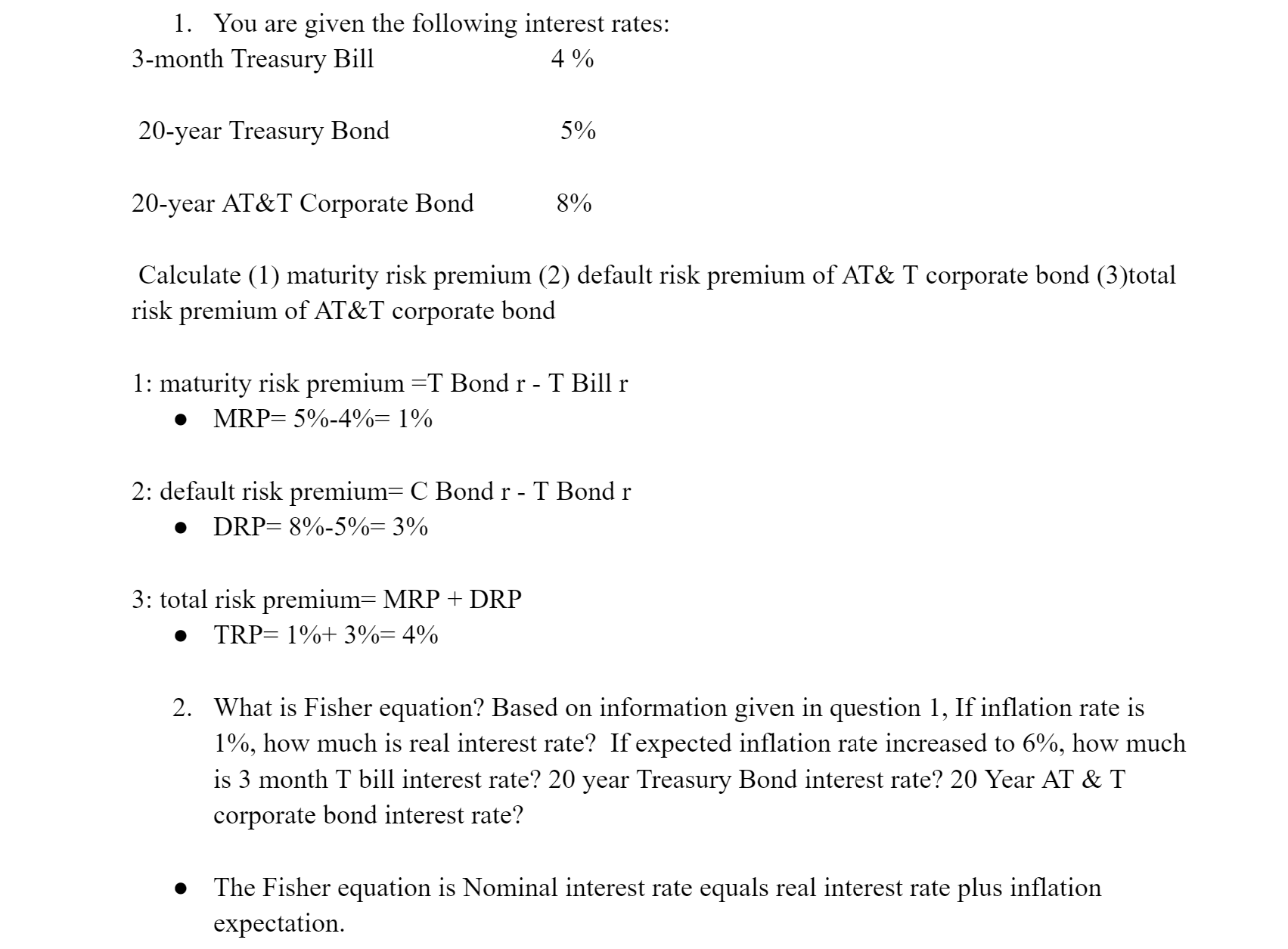

1. You are given the following interest rates: 3-month Treasury Bill 4% 20-year Treasury Bond 5% 20 -year AT\&T Corporate Bond 8% Calculate (1) maturity risk premium (2) default risk premium of AT\& T corporate bond (3)total risk premium of AT\&T corporate bond 1: maturity risk premium =T Bond rT Bill r - MRP=5%4%=1% 2: default risk premium =C Bond rT Bond r - DRP=8%5%=3% 3: total risk premium =MRP+DRP - TRP=1%+3%=4% 2. What is Fisher equation? Based on information given in question 1, If inflation rate is 1%, how much is real interest rate? If expected inflation rate increased to 6%, how much is 3 month T bill interest rate? 20 year Treasury Bond interest rate? 20 Year AT \& T corporate bond interest rate? - The Fisher equation is Nominal interest rate equals real interest rate plus inflation expectation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts