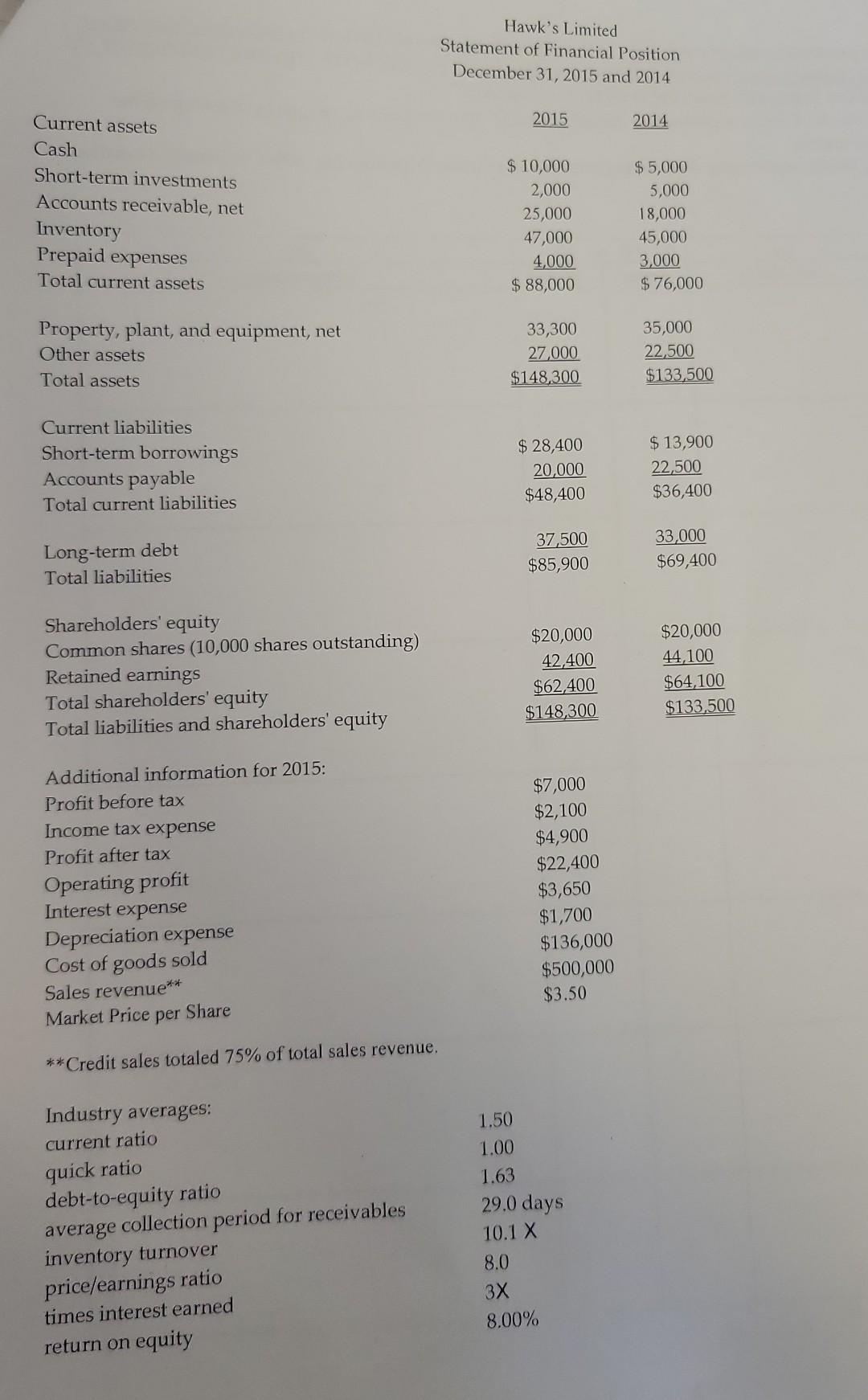

Question: based on information provided, a)calculate Hawk's Limited ratio values for 2015 b) indicate whether Hawk's ratio is performing better or worse than industry average. c)

based on information provided, a)calculate Hawk's Limited ratio values for 2015 b) indicate whether Hawk's ratio is performing better or worse than industry average. c) briefly explain why ratio indicates Hawk's Limited is performing better or worse.

Hawk's Limited Statement of Financial Position December 31, 2015 and 2014 Current assets 20152014 Cash Short-terminvestmentsAccountsreceivable,netInventoryPrepaidexpensesTotalcurrentassetsProperty,plant,andequipment,netOtherassetsTotalassets$10,0002,00025,00047,0004,000$88,00033,30027,000$148,300$5,0005,00018,00045,0003,000$76,00035,00022,500$3133,500 Current liabilities Short-termborrowingsAccountspayableTotalcurrentliabilitiesLong-termdebtTotalliabilities$28,40020,000$48,40037,500$85,900$13,90022,500$36,40033,000$69,400 ShareholdersequityCommonshares(10,000sharesoutstanding)RetainedearningsTotalshareholdersequity$20,00042,400$62,400$133,500$20,00044,100$148,100 Additional information for 2015: Profit before tax Income tax expense Profit after tax Operating profit Interest expense Depreciation expense Cost of goods sold Sales revenue** Market Price per Share $7,000 $2,100 $4,900 $22,400 $3,650 $1,700 $1,700 $500,000 **Credit sales totaled 75% of total sales revenue. Industry averages: current ratio $3.50 quick ratio 1.50 debt-to-equity ratio 1.60 average collection period for receivables 29.0 days inventory turnover 10.1X price/earnings ratio 8.0 times interest earned 3x return on equity 8.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts