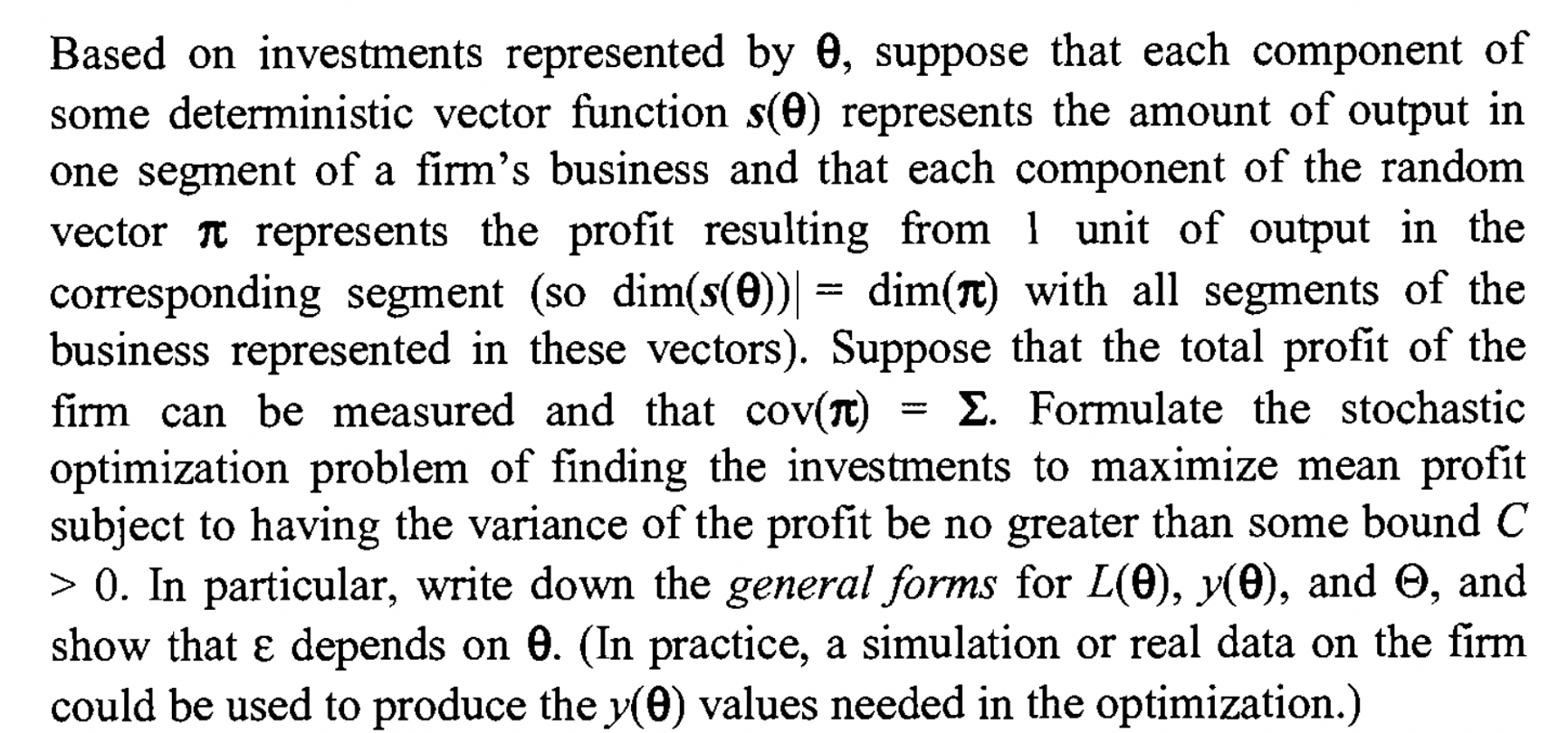

Question: Based on investments represented by e, suppose that each component of some deterministic vector function s(8) represents the amount of output in one segment of

Based on investments represented by e, suppose that each component of some deterministic vector function s(8) represents the amount of output in one segment of a firm's business and that each component of the random vector it represents the profit resulting from 1 unit of output in the corresponding segment (so dim(s(O)) = dim(Tt) with all segments of the business represented in these vectors). Suppose that the total profit of the firm can be measured and that cov(Tt) 2. Formulate the stochastic optimization problem of finding the investments to maximize mean profit subject to having the variance of the profit be no greater than some bound C > 0. In particular, write down the general forms for L(0), y(0), and , and show that depends on 0. (In practice, a simulation or real data on the firm could be used to produce the y(O) values needed in the optimization.) Based on investments represented by e, suppose that each component of some deterministic vector function s(8) represents the amount of output in one segment of a firm's business and that each component of the random vector it represents the profit resulting from 1 unit of output in the corresponding segment (so dim(s(O)) = dim(Tt) with all segments of the business represented in these vectors). Suppose that the total profit of the firm can be measured and that cov(Tt) 2. Formulate the stochastic optimization problem of finding the investments to maximize mean profit subject to having the variance of the profit be no greater than some bound C > 0. In particular, write down the general forms for L(0), y(0), and , and show that depends on 0. (In practice, a simulation or real data on the firm could be used to produce the y(O) values needed in the optimization.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts