Question: Based on my below paper and the below attachments, what corrections can I make to reflect monetary differences with IFRS and US GAAP for Coca-Cola

Based on my below paper and the below attachments, what corrections can I make to reflect monetary differences with IFRS and US GAAP for Coca-Cola FEMSA?

"To determine the monetary difference between IFRS and US GAAP for Coca-Cola FEMSA (KOF), we need to consider how each accounting standard treats various financial elements differently. The breakdown of how this issue can be approached when understanding IFRS and US GAAP Differences has many challenges.?

The negative or loss observed in the years 2022 and 2023 under IFRS reflects a decrease in the monetary position gain due to a reduced net liabilities position in hyperinflationary economies. Under US GAAP, this would be presented differently, primarily affecting the foreign exchange gains or losses rather than a monetary position gain. Hence, the monetary difference between IFRS and US GAAP for Coca-Cola FEMSA in Mexican Pesos and US Dollars would depend on these variations in accounting treatment.

To determine a monetary difference between IFRS (International Financial Reporting Standards) and US GAAP (Generally Accepted Accounting Principles) for Coca-Cola FEMSA, we need to analyze specific items in the financial statements that are affected by differences in these accounting frameworks. One such item is the "Gain on monetary position for subsidiaries in hyperinflationary economies."

Understanding Hyperinflationary Economies and Accounting Treatment

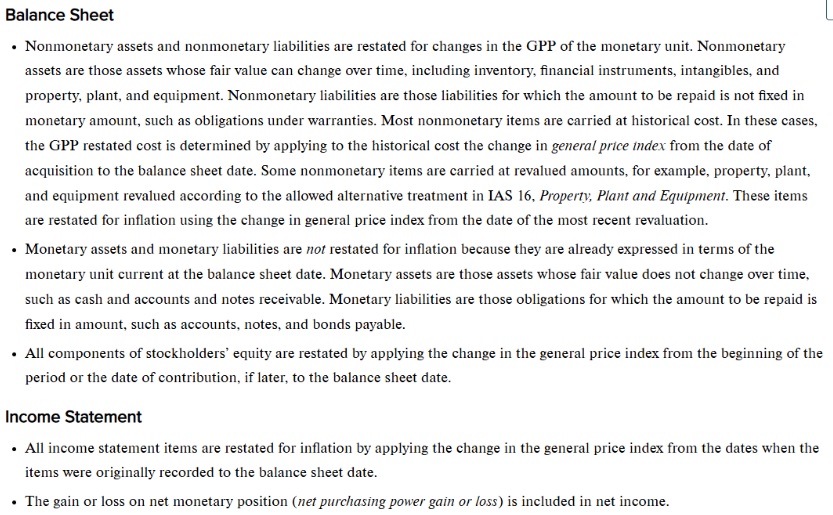

Under IFRS, IAS 29 Financial Reporting in Hyperinflationary Economies requires the financial statements of entities in hyperinflationary economies to be adjusted to reflect the effects of inflation. This results in a gain or loss on the monetary position, which reflects the change in purchasing power of monetary items due to inflation. US GAAP does not have a direct equivalent to IAS 29. Instead, it requires the use of the temporal method for translating the financial statements of subsidiaries in hyperinflationary economies, where monetary items are translated at the current exchange rate, and non-monetary items are translated at historical rates.

The analysis of Coca-Cola FEMSA's monetary position gain based on the provided financial data is as follows:

2023: Gain on monetary position: 93 million Ps.

2022: Gain on monetary position: 536 million Ps.

2021: Gain on monetary position: 734 million Ps.

The monetary position gain for Coca-Cola FEMSA arises due to hyperinflationary accounting under IFRS. If the company were reporting under US GAAP, the treatment would be different because with IFRS Coca-Cola FEMSA records a monetary position gain in hyperinflationary subsidiaries, reflecting the change in purchasing power. With US GAAP Coca-Cola FEMSA would not record a similar gain. Instead, the financial statements of the hyperinflationary subsidiary would be translated using the temporal method, resulting in different foreign exchange gains or losses.

In calculating the monetary difference and to determine the specific monetary difference between IFRS and US GAAP, we would need to translate the financial statements under US GAAP guidelines and compare the results. However, we can infer that the reported gains under IFRS might not exist under US GAAP or would be presented differently as foreign exchange gains or losses. To Summarize the observation, we look at 2023 in which Coca-Cola FEMSA recorded a monetary position gain of 93 million Ps. Under US GAAP, this specific gain might not be recorded, and the financial statements would show different figures for foreign exchange gains or losses. In 2022 the monetary positional gain was 536 million Ps., indicating a lower gain compared to 2021. Under US GAAP, this would again be treated differently. In 2021 the monetary positional gain was 734 million Ps. Like previous years, this would be treated differently under US GAAP.

In Conclusion the negative or loss observed in the years 2022 and 2023 under IFRS reflects a decrease in the monetary position gain due to a reduced net liabilities position in hyperinflationary economies. Under US GAAP, this would be presented differently, primarily affecting the foreign exchange gains or losses rather than a monetary position gain. Hence, the monetary difference between IFRS and US GAAP for Coca-Cola FEMSA in Mexican Pesos and US Dollars would depend on these variations in accounting treatment.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts