Question: Based on past experience, Maas Corporation ( a U . S . - based company ) expects to purchase raw materials from a foreign supplier

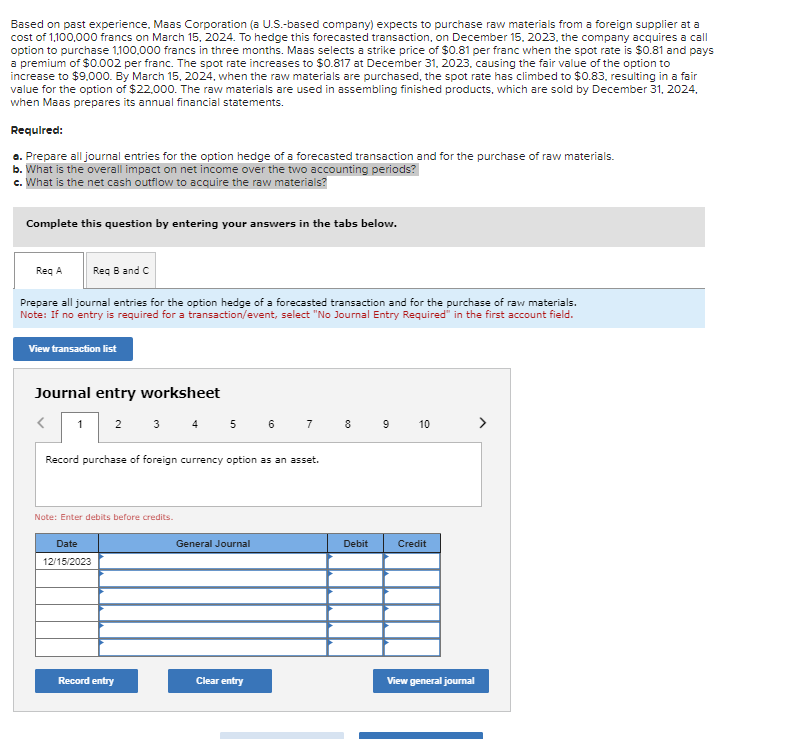

Based on past experience, Maas Corporation a USbased company expects to purchase raw materials from a foreign supplier at a cost of francs on March To hedge this forecasted transaction, on December the company acquires a call option to purchase francs in three months. Maas selects a strike price of $ per franc when the spot rate is $ and pays a premium of $ per franc. The spot rate increases to $ at December causing the fair value of the option to increase to $ By March when the raw materials are purchased, the spot rate has climbed to $ resulting in a fair value for the option of $ The raw materials are used in assembling finished products, which are sold by December when Maas prepares its annual financial statements.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock