Question: Based on past experience, Maas Corporation ( a U . S . - based company ) expects to purchase raw materlals from a forelgn supplier

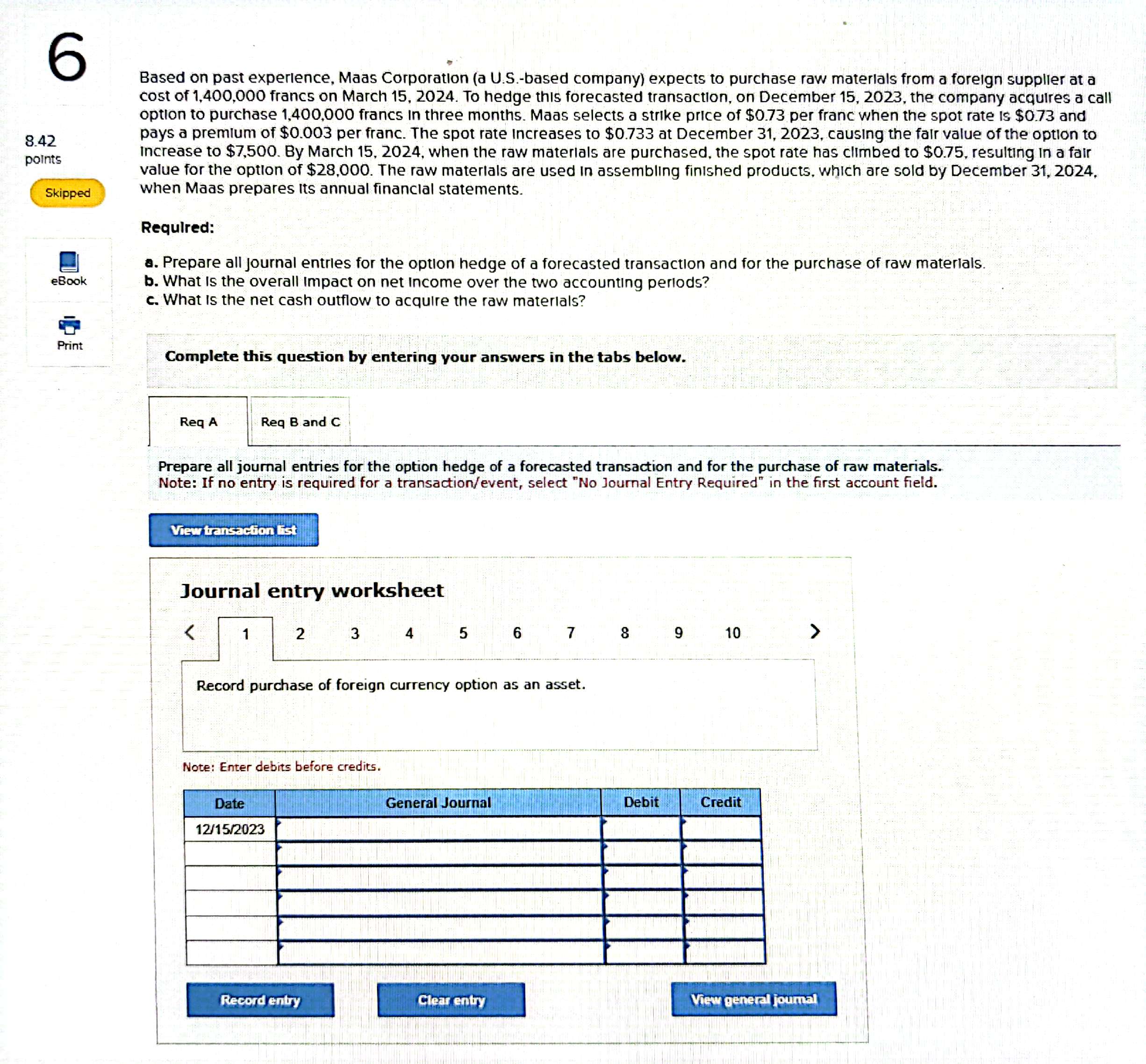

Based on past experience, Maas Corporation a USbased company expects to purchase raw materlals from a forelgn supplier at a

cost of francs on March To hedge this forecasted transaction, on December the company acquires a call

option to purchase francs in three months. Maas selects a strike price of $ per franc when the spot rate is $ and

points

pays a premium of $ per franc. The spot rate increases to $ at December causing the falr value of the option to

increase to $ By March when the raw materials are purchased, the spot rate has climbed to $ resulting in a fair

value for the option of $ The raw matertals are used in assembling finished products, which are sold by December

when Maas prepares its annual financlal statements.

Required:

a Prepare all journal entrles for the option hedge of a forecasted transaction and for the purchase of raw materials.

b What is the overall impact on net income over the two accounting periods?

c What is the net cash outflow to acquire the raw materlals?

Complete this question by entering your answers in the tabs below.

Req A

Req and

Prepare all journal entries for the option hedge of a forecasted transaction and for the purchase of raw materials.

Note: If no entry is required for a transactionevent select No Journal Entry Required" in the first account field.

Journal entry worksheet

Record purchase of foreign currency option as an asset.

Note: Enter debits before credits.

please answer patrt a b and c

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock