Question: based on Restaurant L'Entrecote. You will offer a fixed menu of salad, steak, and french fries. You plan to run the restaurant for two years

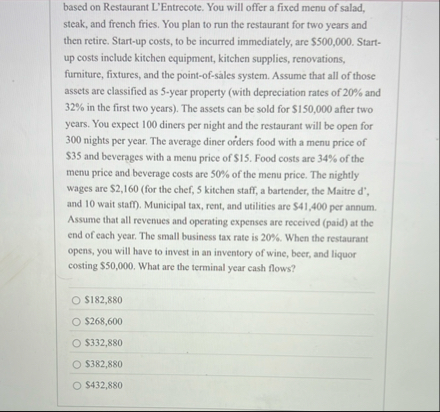

based on Restaurant L'Entrecote. You will offer a fixed menu of salad, steak, and french fries. You plan to run the restaurant for two years and then retire. Startup costs, to be incurred immediately, are $ Startup costs include kitchen equipment, kitchen supplies, renovations, fumiture, fixtures, and the pointofsales system. Assume that all of those assets are classified as year property with depreciation rates of and in the first two years The assets can be sold for $ after two years. You expect diners per night and the restaurant will be open for nights per year. The average diner orders food with a menu price of $ and beverages with a menu price of $ Food costs are of the menu price and beverage costs are of the menu price. The nightly wages are $for the chef, kitchen staff, a bartender, the Maitre d and wait staff Municipal tax, rent, and utilities are $ per annum. Assume that all revenues and operating expenses are received paid at the end of each year. The small business tax rate is When the restaurant opens, you will have to invest in an inventory of wine, beer, and liquor costing $ What are the terminal year cash flows?

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock