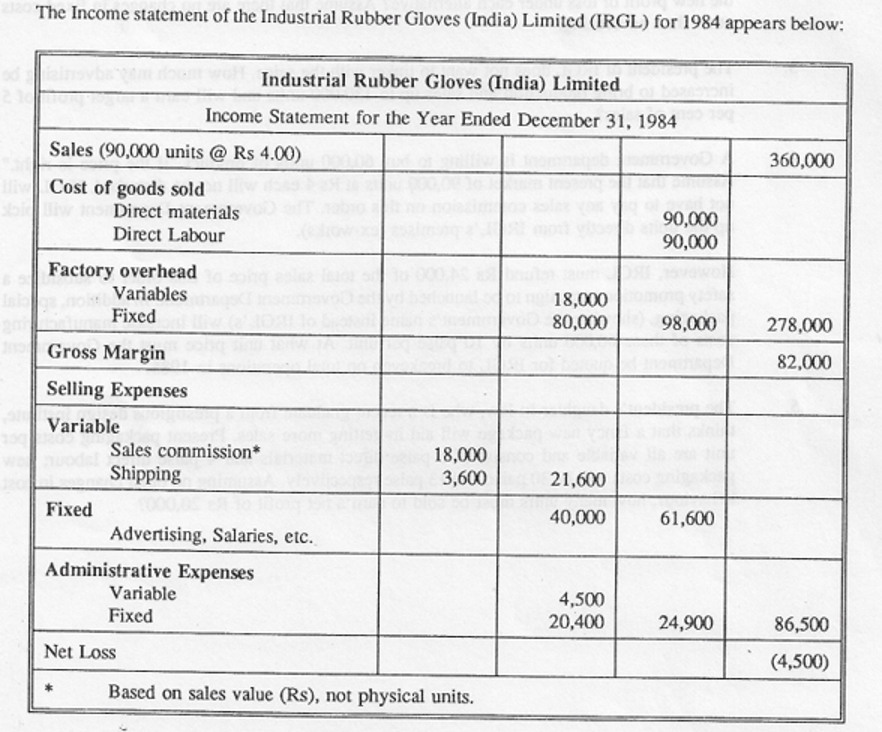

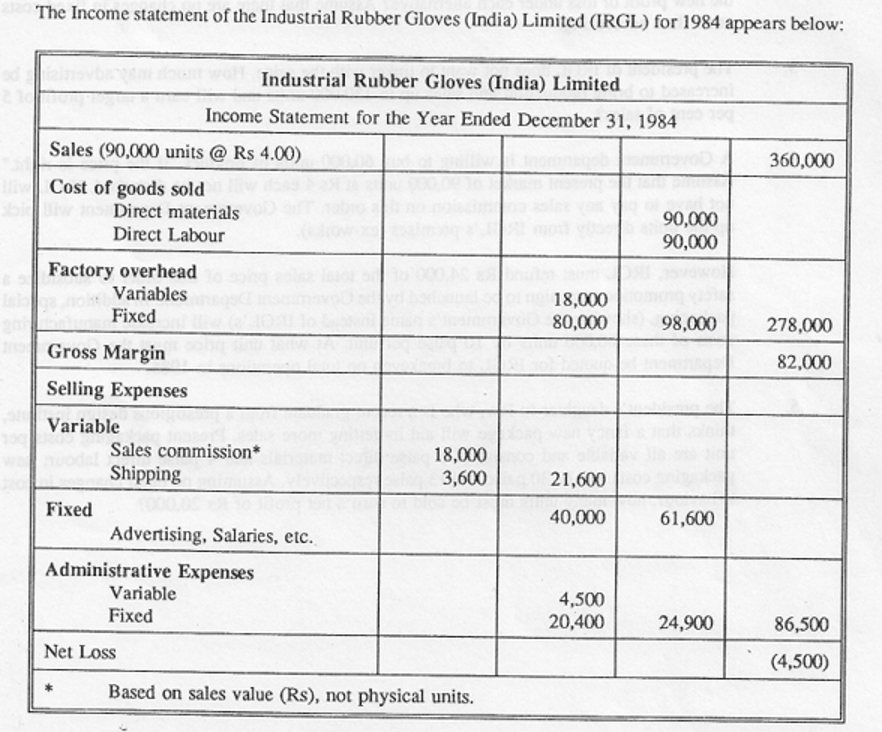

Question: Based on sales value ( Rs ) , not physical units. Commissions are based on sales revenue; all other variable expenses vary in terms of

Based on sales value Rs not physical units.

Commissions are based on sales revenue; all other variable expenses vary in terms of units sold.

The factory has a capacity of units per year. The results for have been disappointing.

Top management is exptoring a number of possible ways to make operations protable in

Required: Consider each situation independently

Recast the income statement into a contribution format. There will be three major sections:

sales, variable expenses and xed expenses. Also note that "contribution" is the difference

between "sales" and variable costs", which "contributes" towards recovery of xed costs. As

such, surplus contribution over xed costs is prot and deciency is loss Show costs per unit

in an adjacent column. Allow adjacent space for entering your answers to question two.

The sales manager of IRGL.is torn between two courses of action:

a He has studied the market potential and believes that a cut in price would ll the

plant to capacity.b He wants to increase prices by to increase advertising by Rs and to

boost commissions to per cent of sales. Under these circumstances, he thinks that

unit volume will increase by per cent.

Prepare the budgeted income statement, using a contribution margin format. What would be

the new prot or loss under each alternative? Assume that there are no changes in xed costs

other than advertising.

The president of IRGL does not want to tinker with the price. How much may advertising be

increased to bring production and sales up to units and will earn a target prot of

per cent of sales?

A Government department is willing to buy units of product if the price is right."

Assume that the present market of units at Rs each will not be disturbed. IRGL will

not have to pay any sales commission on this order. The Government Department will pick

up the units directly from IRGLs premises exworks

However, IRGL must refund Rs of the total sales price of this order to subsidize a

safety promotion campaign to be launched by the Government Department. In addition, special

packaging, showing the Govemments name instead of IRGLs will increase manufacturing

costs of these units by paise per unit. At what unit price must the Govemment

Department be quoted for IRGL to breakeven on total operations in

The presidents daughterinlaw, who is a recent graduate from a prestigious design institute,

thinks that a fancy new package will aid in getting more sales. Present packaging costs per

unit are all variable and consist of paise direct materials and paise direct labour", new

packaging costs will be paise and paise respectively. Assuming no other changes in cost

behaviour, how many units must be sold to earn a net prot of Rs

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock