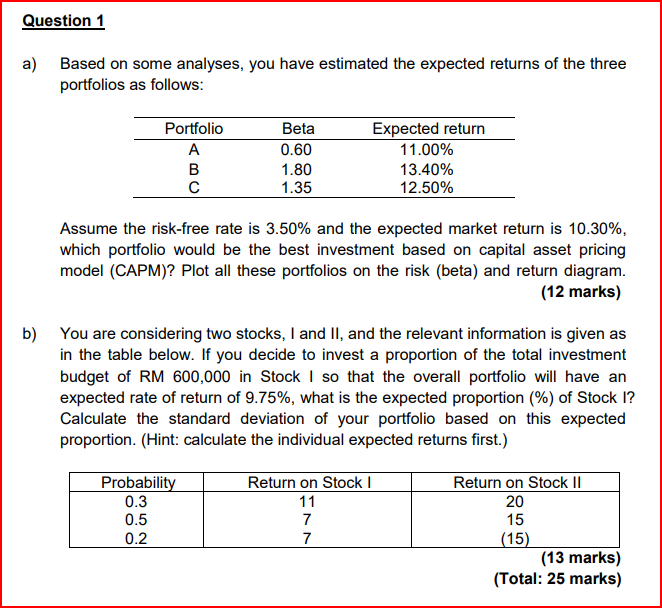

Question: Based on some analyses, you have estimated the expected returns of the three portfolios as follows: Assume the risk-free rate is 3.50% and the expected

Based on some analyses, you have estimated the expected returns of the three portfolios as follows: Assume the risk-free rate is 3.50% and the expected market return is 10.30%, which portfolio would be the best investment based on capital asset pricing model (CAPM)? Plot all these portfolios on the risk (beta) and return diagram. (12 marks) You are considering two stocks, I and II, and the relevant information is given as in the table below. If you decide to invest a proportion of the total investment budget of RM 600,000 in Stock I so that the overall portfolio will have an expected rate of return of 9.75%, what is the expected proportion (\%) of Stock I? Calculate the standard deviation of your portfolio based on this expected proportion. (Hint: calculate the individual expected returns first.) (13 marks) (Total: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts