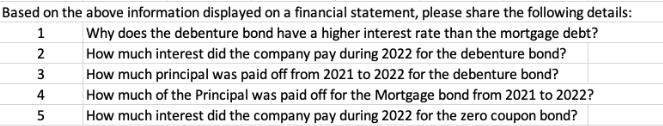

Question: Based on the above information displayed on a financial statement, please share the following details: 1 Why does the debenture bond have a higher

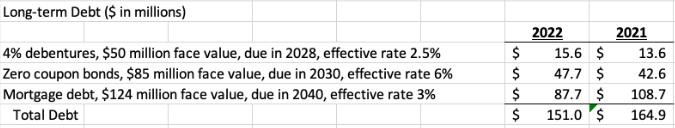

Based on the above information displayed on a financial statement, please share the following details: 1 Why does the debenture bond have a higher interest rate than the mortgage debt? How much interest did the company pay during 2022 for the debenture bond? 2 3 How much principal was paid off from 2021 to 2022 for the debenture bond? 4 5 How much of the Principal was paid off for the Mortgage bond from 2021 to 2022? How much interest did the company pay during 2022 for the zero coupon bond? Long-term Debt ($ in millions) 4% debentures, $50 million face value, due in 2028, effective rate 2.5% Zero coupon bonds, $85 million face value, due in 2030, effective rate 6% Mortgage debt, $124 million face value, due in 2040, effective rate 3% Total Debt 2022 2021 $ 15.6 $ 13.6 $ 47.7 $ 42.6 $ 87.7 $ 108.7 $ 151.0 $ 164.9

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

1 The debenture bond likely has a higher interest rate than the mortgage debt because it is unsecure... View full answer

Get step-by-step solutions from verified subject matter experts