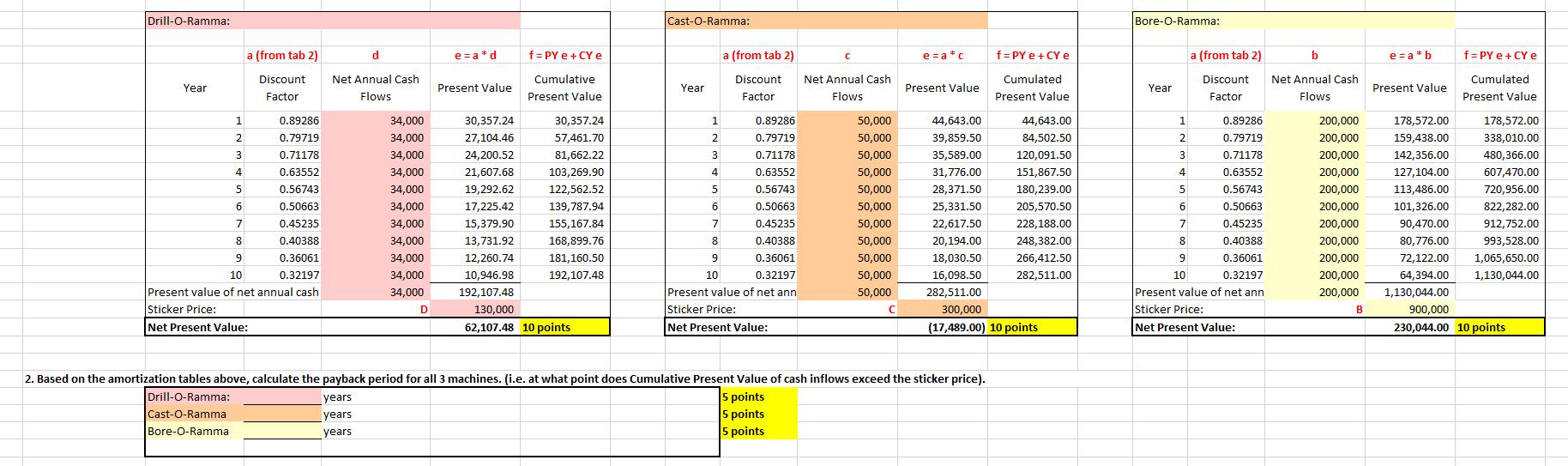

Question: Based on the amortization tables, calculate the payback period for all 3 machines. (i.e. at what point does Cumulative Present Value of cash inflows exceed

Based on the amortization tables, calculate the payback period for all 3 machines. (i.e. at what point does Cumulative Present Value of cash inflows exceed the sticker price).

Drill-O-Ramma: Year a (from tab 2) Discount Factor 1 0.89286 2 0.79719 3 0.71178 4 0.63552 5 0.56743 6 0.50663 7 0.45235 8 0.40388 9 0.36061 10 0.32197 Present value of net annual cash Sticker Price: Net Present Value: d Net Annual Cash Flows 34,000 34,000 34,000 34,000 34,000 34,000 34,000 34,000 34,000 34,000 34,000 years years years D e=a*d Present Value f=PY e + CY e Cumulative Present Value 30,357.24 57,461.70 81,662.22 103,269.90 122,562.52 139,787.94 155,167.84 168,899.76 181,160.50 192,107.48 30,357.24 27,104.46 24,200.52 21,607.68 19,292.62 17,225.42 15,379.90 13,731.92 12,260.74 10,946.98 192,107.48 130,000 62,107.48 10 points Cast-O-Ramma: Year a (from tab 2) Discount Factor 0.89286 0.79719 0.71178 0.63552 0.56743 0.50663 0.45235 0.40388 9 0.36061 10 0.32197 Present value of net ann Sticker Price: Net Present Value: 1 2 3 4 5 6 7 8 Net Annual Cash Flows 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 50,000 C e=a* c Present Value 2. Based on the amortization tables above, calculate the payback period for all 3 machines. (i.e. at what point does Cumulative Present Value of cash inflows exceed the sticker price). Drill-O-Ramma: 5 points Cast-O-Ramma 5 points Bore-O-Ramma 5 points f=PY e + CY e Cumulated Present Value 44,643.00 84,502.50 120,091.50 151,867.50 180,239.00 205,570.50 228,188.00 248,382.00 266,412.50 282,511.00 44,643.00 39,859.50 35,589.00 31,776.00 28,371.50 25,331.50 22,617.50 20,194.00 18,030.50 16,098.50 282,511.00 300,000 (17,489.00) 10 points Bore-O-Ramma: Year a (from tab 2) Discount Factor 0.89286 0.79719 0.71178 0.63552 0.56743 0.50663 0.45235 0.40388 0.36061 10 0.32197 Present value of net ann Sticker Price: 1 2 3 4 5 6 7 8 9 Net Present Value: b Net Annual Cash Flows 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 B e=a* b Present Value 178,572.00 159,438.00 142,356.00 127,104.00 113,486.00 101,326.00 90,470.00 80,776.00 72,122.00 64,394.00 1,130,044.00 f=PY e + CY e Cumulated Present Value 178,572.00 338,010.00 480,366.00 607,470.00 720,956.00 822,282.00 912,752.00 993,528.00 1,065,650.00 1,130,044.00 900,000 230,044.00 10 points

Step by Step Solution

3.41 Rating (173 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts