Question: Based on the analysis in case Exhibit 9, what is the anticipated CPK share price under each scenario? How many shares will CPK be likely

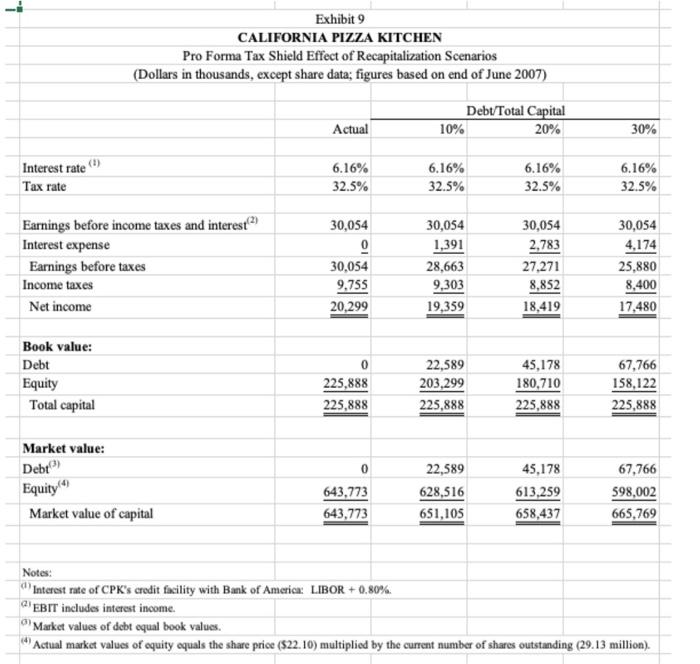

Exhibit 9 CALIFORNIA PIZZA KITCHEN Pro Forma Tax Shield Effect of Recapitalization Scenarios (Dollars in thousands, except share data; figures based on end of June 2007) Actual Debt/Total Capital 10% 20% 30% Interest rate Tax rate 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% Earnings before income taxes and interest Interest expense Earnings before taxes Income taxes Net income 30,054 0 30,054 9.755 20,299 30,054 1,391 28,663 9,303 19,359 30,054 2,783 27,271 8,852 18,419 30,054 4,174 25,880 8,400 17,480 Book value: Debt Equity Total capital 225,888 225,888 22,589 203,299 225,888 45,178 180.710 225,888 67,766 158,122 225,888 0 67,766 Market value: Debt Equity" Market value of capital 643,773 643,773 22,589 628,516 651,105 45,178 613,259 658,437 598,002 665,769 Notes: Interest rate of CPK's credit facility with Bank of America: LIBOR +0.80%. EBIT includes interest income. "Market values of debt equal book values. "Actual market values of equity equals the share price ($22. 10) multiplied by the current number of shares outstanding (29.13 million)

Step by Step Solution

There are 3 Steps involved in it

To address the question lets break it down into three parts 1 Anticipated CPK Share Price Under Each ... View full answer

Get step-by-step solutions from verified subject matter experts