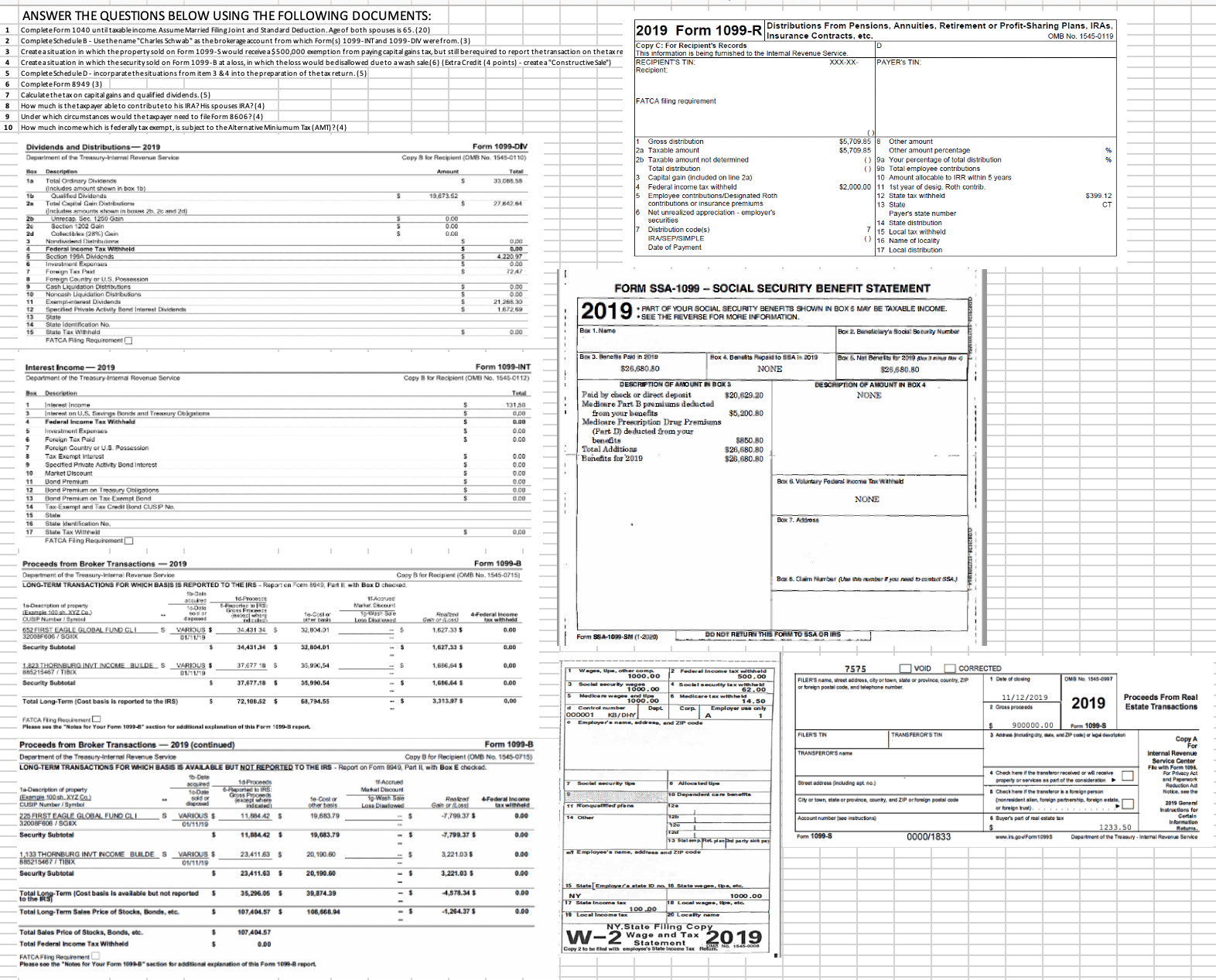

Question: Based on the attached document: 1 Complete Form 1 0 4 0 until taxable income. Assume Married Filing Joint and Standard Deduction. Age of both

Based on the attached document: Complete Form until taxable income. Assume Married Filing Joint and Standard Deduction. Age of both spouses is

Complete Schedule B Use the name "Charles Schwab" as the brokerage account from which FormsINT and DIV were from.

Create a situation in which the property sold on Form S would receive a $ exemption from paying capital gains tax, but still be required to report the transaction on the tax return.

Create a situation in which the security sold on Form B at a loss, in which the loss would be disallowed due to a wash sale.Extra Credit points create a "Constructive Sale"

Complete Schedule D incorparate the situations from item & into the preparation of the tax return.

Complete Form

Calculate the tax on capital gains and qualified dividends.

How much is the taxpayer able to contribute to his IRA? His spouses IRA?

Under which circumstances would the taxpayer need to file Form

How much income which is federally tax exempt, is subject to the Alternative Miniumum Tax AMT

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock