Question: based on the attached, provide a comprehensive analysis focusing on the importance of correlation and diversification in a portfolio construction and on the importance of

based on the attached, provide a comprehensive analysis focusing on the importance of correlation and diversification in a portfolio construction and on the importance of assessing expected returns on a risk-adjusted basis and the Sharpe ratio

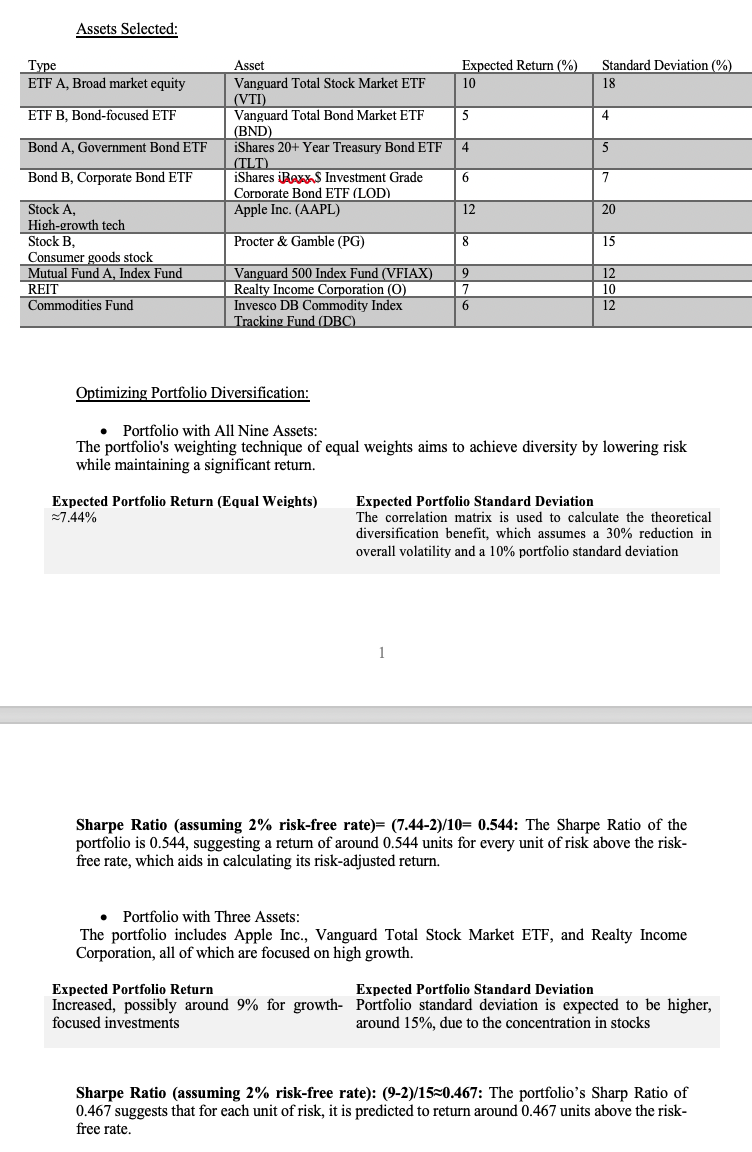

Assets Selected: Type Asset Expected Return (%) Standard Deviation (%) ETF A, Broad market equity Vanguard Total Stock Market ETF 10 18 (VTI ETF B, Bond-focused ETF Vanguard Total Bond Market ETF 5 4 BND Bond A, Government Bond ETF Shares 20+ Year Treasury Bond ETF 4 5 (TLT) Bond B, Corporate Bond ETF iShares WAYS Investment Grade 6 7 Corporate Bond ETF (LOD) Stock A, Apple Inc. (AAPL) 12 20 High-growth tech Stock B, Procter & Gamble (PG) 8 15 Consumer goods stock Mutual Fund A, Index Fund Vanguard 500 Index Fund (VFIAX) 12 REIT Realty Income Corporation (O) 10 Commodities Fund Invesco DB Commodity Index 12 Tracking Fund (DBC Optimizing Portfolio Diversification: . Portfolio with All Nine Assets: The portfolio's weighting technique of equal weights aims to achieve diversity by lowering risk while maintaining a significant return. Expected Portfolio Return (Equal Weights) Expected Portfolio Standard Deviation -7.44% The correlation matrix is used to calculate the theoretical diversification benefit, which assumes a 30% reduction in overall volatility and a 10% portfolio standard deviation Sharpe Ratio (assuming 2% risk-free rate)= (7.44-2)/10= 0.544: The Sharpe Ratio of the portfolio is 0.544, suggesting a return of around 0.544 units for every unit of risk above the risk- free rate, which aids in calculating its risk-adjusted return. . Portfolio with Three Assets: The portfolio includes Apple Inc., Vanguard Total Stock Market ETF, and Realty Income Corporation, all of which are focused on high growth. Expected Portfolio Return Expected Portfolio Standard Deviation Increased, possibly around 9% for growth- Portfolio standard deviation is expected to be higher, focused investments around 15%, due to the concentration in stocks Sharpe Ratio (assuming 2% risk-free rate): (9-2)/1520.467: The portfolio's Sharp Ratio of 0.467 suggests that for each unit of risk, it is predicted to return around 0.467 units above the risk- free rate