Based on the attached, take the Limited Partner's perspective in the context of financial terms and also what decision rights they require when major decisions are to be made. Finally, what should the LP expect in terms of transparency of the financial decisions and reports generated by the GP?

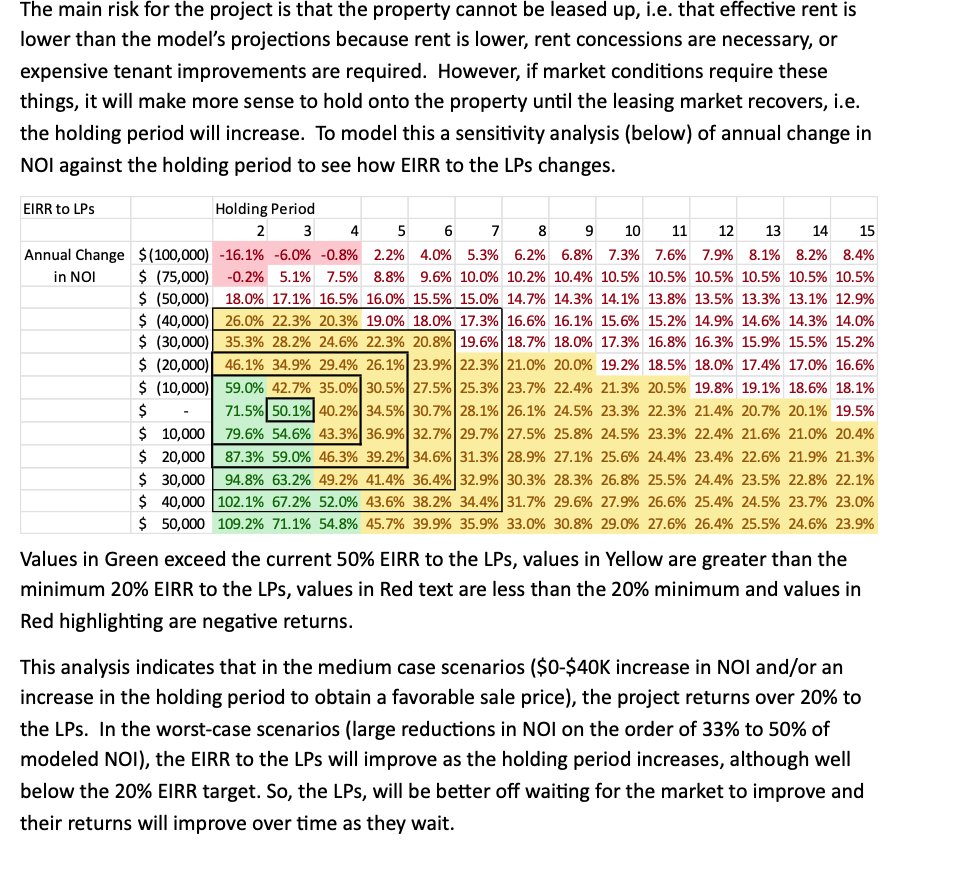

The main risk for the project is that the property cannot be leased up, i.e. that effective rent is lower than the model's projections because rent is lower, rent concessions are necessary, or expensive tenant improvements are required. However, if market conditions require these things, it will make more sense to hold onto the property until the leasing market recovers, i.e. the holding period will increase. To model this a sensitivity analysis (below) of annual change in NOI against the holding period to see how EIRR to the LPs changes. EIRR to LPs Holding Period 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Annual Change 5$(100,000) -16.1% -6.0% -0.8% 2.2% 4.0% 5.3% 62% 68% 7.3% 7.6% 7.9% 8.1% 82% 84% in NOL S (75,000) -0.2% 5.1% 7.5% 88% 9.6% 10.0% 10.2% 10.4% 10.5% 10.5% 10.5% 10.5% 10.5% 10.5% $ (50,000) 18.0% 17.1% 16.5% 16.0% 15.5% 15.0% 14.7% 14.3% 14.1% 13.8% 13.5% 13.3% 13.1% 12.9% $ (40,000)| 26.0% 22.3% 20.3% 19. ; 17.3%] 16.6% 16.1% 15.6% 15.2% 14.9% 14.6% 14.3% 14.0% $ (30,000)} 35.3% 28.2% 24.6% 22. : 19.6%] 18.7% 18.0% 17.3% 16.8% 16.3% 15.9% 15.5% 15.2% $ (20,000)} 46.1% 34.9% 29.4% 26. : 22.3%) 21.0% 20.0% 19.2% 18.5% 18.0% 17.4% 17.0% 16.6% $ (10,000)} 59.0% 42.7% 35.0% 30. : 25.3%) 23.7% 22.4% 21.3% 20.5% 19.8% 19.1% 18.6% 18.1% 5 - 71.5%] 50.194 40.2%] 34. : 28.1%) 26.1% 24.5% 23.3% 22.3% 21.4% 20.7% 20.1% 19.5% S$ 10,000] 79.6% 54.6% 43.3%] 36. . 29.7%) 27.5% 25.8% 24.5% 23.3% 22.4% 21.6% 21.0% 20.4% S$ 20,000] 87.3% 59.0% 46.3% 39. 6%] 31.3%] 28.9% 27.1% 25.6% 24.4% 23.4% 22.6% 21.9% 21.3% S$ 30,000 | 94.8% 63.2% 49.2% 41.4% 36.4%] 32.9%] 30.3% 28.3% 26.8% 25.5% 24.4% 23.5% 22.8% 22.1% $ 40,000 | 102.1% 67.2% 52.0% 43.6% 38.2% 34.4%] 31.7% 29.6% 27.9% 26.6% 25.4% 24.5% 23.7% 23.0% $ 50,000 109.2% 71.1% 54.8% 45.7% 39.9% 35.9% 33.0% 30.8% 29.0% 27.6% 26.4% 25.5% 24.6% 23.9% Values in Green exceed the current 50% EIRR to the LPs, values in Yellow are greater than the minimum 20% EIRR to the LPs, values in Red text are less than the 20% minimum and values in Red highlighting are negative returns. This analysis indicates that in the medium case scenarios (SO0-S40K increase in NOI and/or an increase in the holding period to obtain a favorable sale price), the project returns over 20% to the LPs. In the worst-case scenarios (large reductions in NOI on the order of 33% to 50% of modeled NOI), the EIRR to the LPs will improve as the holding period increases, although well below the 20% EIRR target. So, the LPs, will be better off waiting for the market to improve and their returns will improve over time as they wait