Question: Based on the Balance Sheet that you created on Question # 2 in the Chapter 4 Case Study (attached): Create a schedule of the allocation

Based on the Balance Sheet that you created on Question # 2 in the Chapter 4 Case Study (attached):

Create a schedule of the allocation of the recourse loan among each partner (Alex and Betty). Create a schedule of the allocation of the non-recourse loan among each partner.

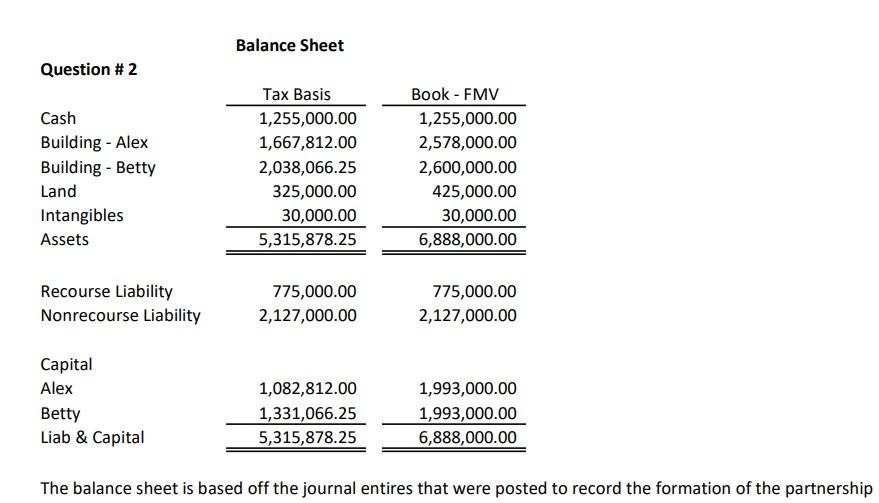

Question # 2 Cash Building - Alex Building - Betty Land Intangibles Assets Recourse Liability Nonrecourse Liability Capital Alex Betty Liab & Capital Balance Sheet Tax Basis 1,255,000.00 1,667,812.00 2,038,066.25 325,000.00 30,000.00 5,315,878.25 775,000.00 2,127,000.00 1,082,812.00 1,331,066.25 5,315,878.25 Book - FMV 1,255,000.00 2,578,000.00 2,600,000.00 425,000.00 30,000.00 6,888,000.00 775,000.00 2,127,000.00 1,993,000.00 1,993,000.00 6,888,000.00 The balance sheet is based off the journal entires that were posted to record the formation of the partnership Question # 2 Cash Building - Alex Building - Betty Land Intangibles Assets Recourse Liability Nonrecourse Liability Capital Alex Betty Liab & Capital Balance Sheet Tax Basis 1,255,000.00 1,667,812.00 2,038,066.25 325,000.00 30,000.00 5,315,878.25 775,000.00 2,127,000.00 1,082,812.00 1,331,066.25 5,315,878.25 Book - FMV 1,255,000.00 2,578,000.00 2,600,000.00 425,000.00 30,000.00 6,888,000.00 775,000.00 2,127,000.00 1,993,000.00 1,993,000.00 6,888,000.00 The balance sheet is based off the journal entires that were posted to record the formation of the partnership

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts