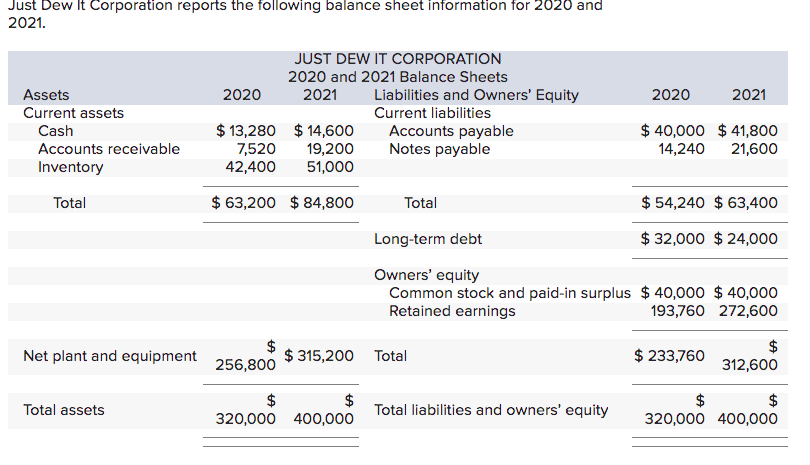

Question: Based on the balance sheets given for Just Dew It: a. Calculate the current ratio for each year. (Do not round intermediate calculations and round

| Based on the balance sheets given for Just Dew It: |

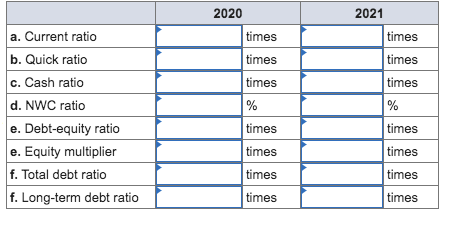

| a. | Calculate the current ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) |

| b. | Calculate the quick ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) |

| c. | Calculate the cash ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) |

| d. | Calculate the NWC to total assets ratio for each year. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) |

| e. | Calculate the debt-equity ratio and equity multiplier for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) |

| f. | Calculate the total debt ratio and long-term debt ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) |

Just Dew it Corporation reports the following balance sheet information for 2020 and 2021. \begin{tabular}{|l|l|l|l|l|} \hline & \multicolumn{2}{|c|}{2020} & \multicolumn{2}{|c|}{2021} \\ \hline a. Current ratio & & times & & times \\ \hline b. Quick ratio & & times & & times \\ \hline c. Cash ratio & & times & & times \\ \hline d. NWC ratio & % & & % \\ \hline e. Debt-equity ratio & & times & & times \\ \hline e. Equity multiplier & & times & & times \\ \hline f. Total debt ratio & & times & & times \\ \hline f. Long-term debt ratio & & times & & times \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock