Question: Based on the balance sheets given for Just Dew It: a. Calculate the current ratio for each year. (Do not round intermediate calculations and

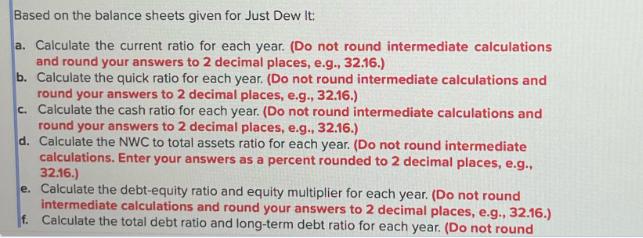

Based on the balance sheets given for Just Dew It: a. Calculate the current ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate the quick ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Calculate the cash ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d. Calculate the NWC to total assets ratio for each year. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) e. Calculate the debt-equity ratio and equity multiplier for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) f. Calculate the total debt ratio and long-term debt ratio for each year. (Do not round Current assets Cash Accounts receivable Inventory Total Net plant and equipment Total assets Assets 2017 $ 8,250 34,500 58,500 $ 101,250 $273,750 JUST DEW IT CORPORATION 2017 and 2018 Balance Sheets 2018 $ 12,240 40,560 86,160 $ 138,960 $ 341,040 $375,000 $480,000 Liabilities and Owners' Equity 2017 Current liabilities Accounts payable Notes payable Total $ 43,500 29,625 Total Long-term debt Owners' equity Common stock and paid-in $60,000 surplus Retained earnings 196,875 Total liabilities and owners' equity $ 73,125 $ 45,000 $256,875 $375,000 2018 $ 48,240 32,160 $ 80,400 $ 36,000 $ 60,000 303,600 $363,600 $480,000

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

a Current Ratio The current ratio is calculated by dividing current assets by current liabilities For 2017 Current Ratio Current Assets Current Liabil... View full answer

Get step-by-step solutions from verified subject matter experts