Question: Based on the below information, prepare proforma statements for years 2015 to 2020 for AFTER the merger under the following two scenarios: 1. Assuming 100%

Based on the below information, prepare proforma statements for years 2015 to 2020 for AFTER the merger under the following two scenarios:

1. Assuming 100% debt financing

2. Mix of debt and equity

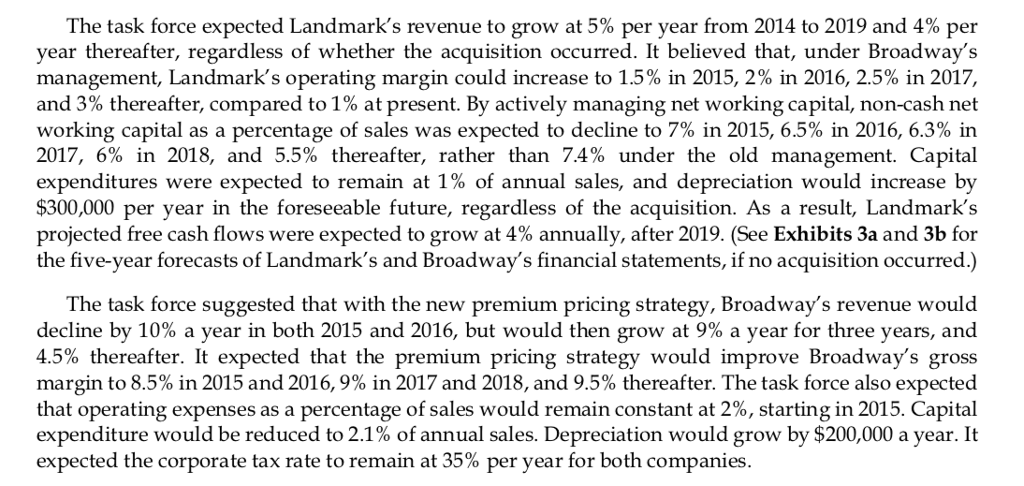

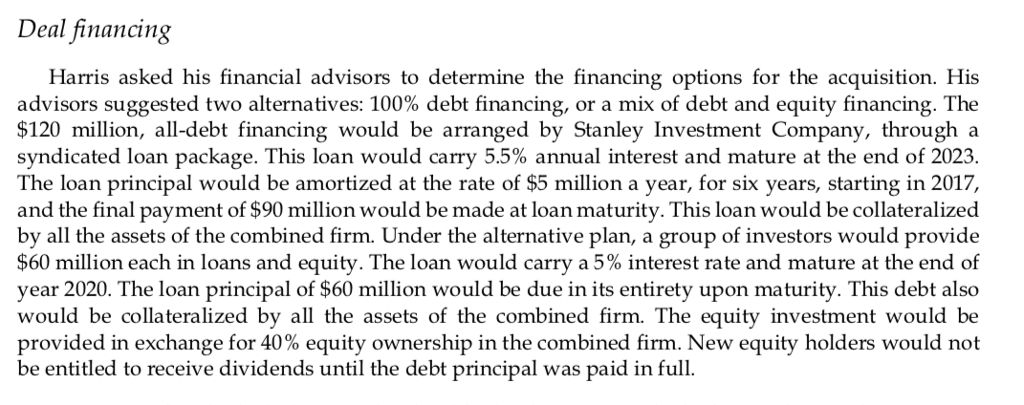

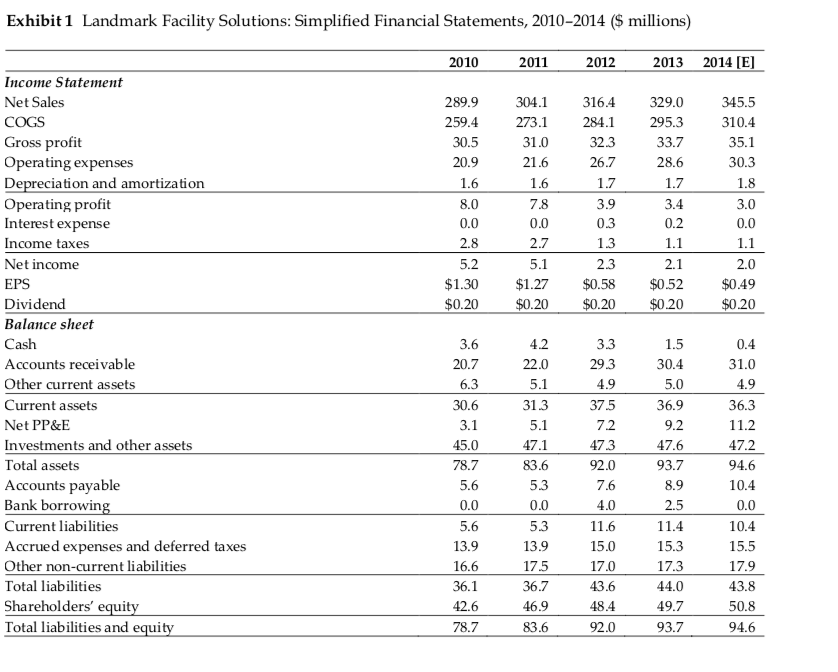

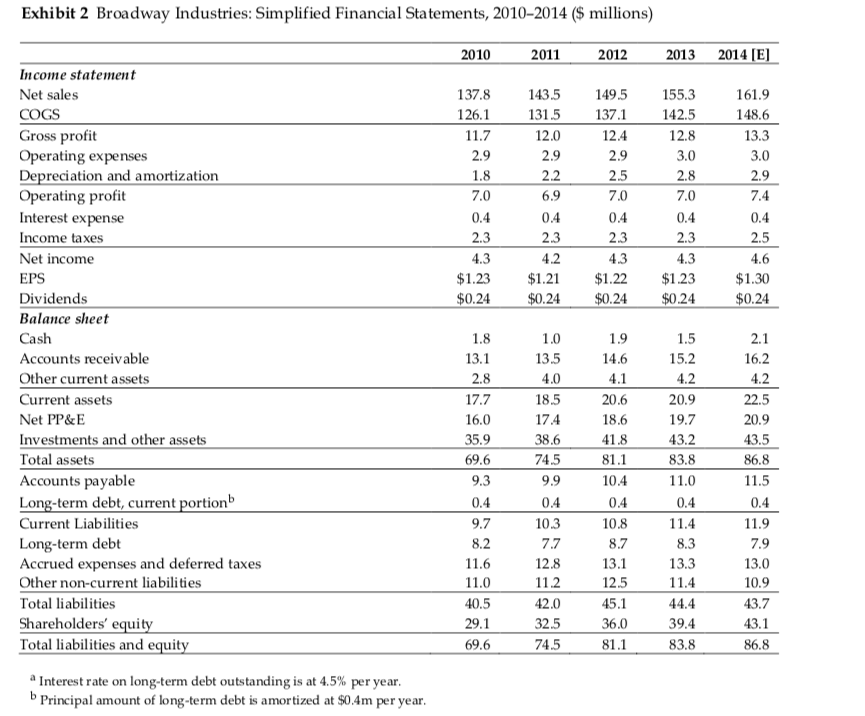

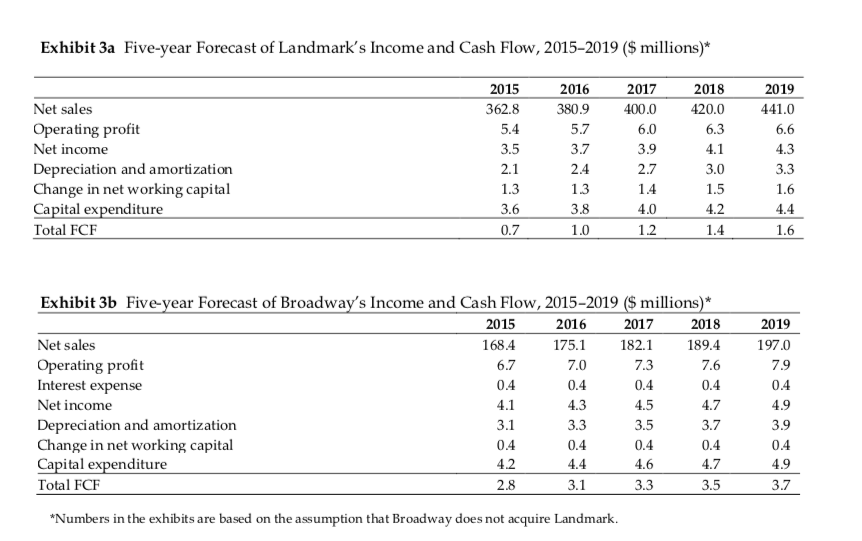

The task force expected Landmark's revenue to grow at 5% per year from 2014 to 2019 and 4% per year thereafter, regardless of whether the acquisition occurred. It believed that, under Broadway's management, Landmark's operating margin could increase to 15% in 2015, 2% in 2016, 2.5% in 2017, and 3% thereafter, compared to 1% at present. By actively managing net working capital, non-cash net working capital as a percentage of sales was expected to decline to 7% in 2015, 6.5% in 2016, 6.3% in 2017, 6% in 2018, and 5.5% thereafter, rather than 7.4% under the old management. Capital expenditures were expected to remain at 1%, of annual sales, and depreciation would increase by $300,000 per year in the foreseeable future, regardless of the acquisition. As a result, Landmark's projected free cash flows were expected to grow at 4% annually, after 2019, (See Exhibits 3a and 3b for the five-year forecasts of Landmark's and Broadway's financial statements, if no acquisition occurred.) The task force suggested that with the new premium pricing strategy, Broadway's revenue would decline by 10% a year in both 2015 and 2016, but would then grow at 9% a year for three years, and 4.5% thereafter. It expected that the premium pricing strategy would improve Broadway's gross margin to 8.5% in 2015 and 2016, 9% in 2017 and 2018, and 9.5% thereafter. The task force also expected that operating expenses as a percentage of sales would remain constant at 2%, starting in 2015, Capital expenditure would be reduced to 2.1% of annual sales. Depreciation would grow by $200,000 a year. It expected the corporate tax rate to remain at 35% per year for both companies The task force expected Landmark's revenue to grow at 5% per year from 2014 to 2019 and 4% per year thereafter, regardless of whether the acquisition occurred. It believed that, under Broadway's management, Landmark's operating margin could increase to 15% in 2015, 2% in 2016, 2.5% in 2017, and 3% thereafter, compared to 1% at present. By actively managing net working capital, non-cash net working capital as a percentage of sales was expected to decline to 7% in 2015, 6.5% in 2016, 6.3% in 2017, 6% in 2018, and 5.5% thereafter, rather than 7.4% under the old management. Capital expenditures were expected to remain at 1%, of annual sales, and depreciation would increase by $300,000 per year in the foreseeable future, regardless of the acquisition. As a result, Landmark's projected free cash flows were expected to grow at 4% annually, after 2019, (See Exhibits 3a and 3b for the five-year forecasts of Landmark's and Broadway's financial statements, if no acquisition occurred.) The task force suggested that with the new premium pricing strategy, Broadway's revenue would decline by 10% a year in both 2015 and 2016, but would then grow at 9% a year for three years, and 4.5% thereafter. It expected that the premium pricing strategy would improve Broadway's gross margin to 8.5% in 2015 and 2016, 9% in 2017 and 2018, and 9.5% thereafter. The task force also expected that operating expenses as a percentage of sales would remain constant at 2%, starting in 2015, Capital expenditure would be reduced to 2.1% of annual sales. Depreciation would grow by $200,000 a year. It expected the corporate tax rate to remain at 35% per year for both companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts