Question: Based on the below question, calculate the Weighted Average Cost ofCapital (WACC) Questions with numbers in blue have answers at the back of the book.

Based on the below question, calculate the Weighted Average Cost ofCapital (WACC)

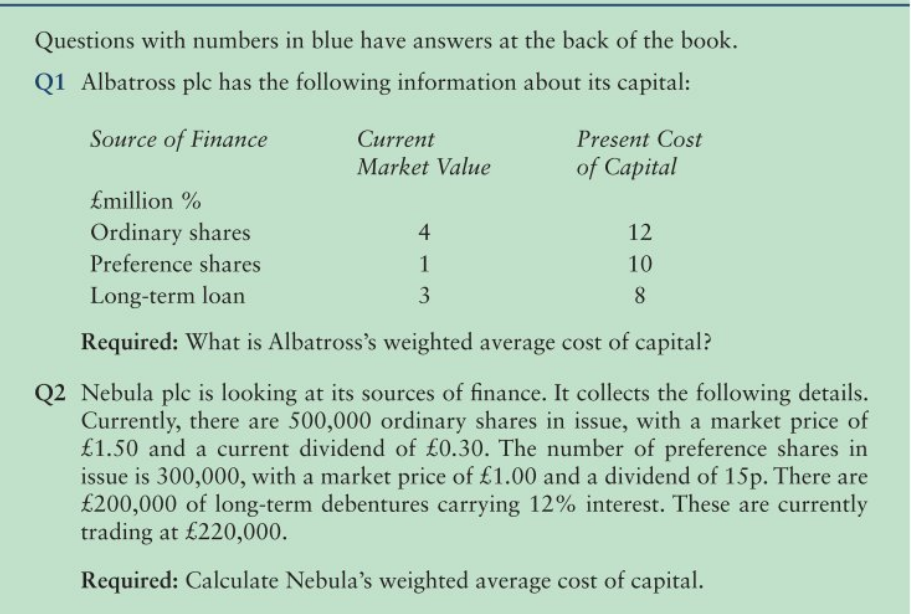

Questions with numbers in blue have answers at the back of the book. Q1 Albatross plc has the following information about its capital: Required: What is Albatross's weighted average cost of capital? Q2 Nebula plc is looking at its sources of finance. It collects the following details. Currently, there are 500,000 ordinary shares in issue, with a market price of 1.50 and a current dividend of 0.30. The number of preference shares in issue is 300,000 , with a market price of 1.00 and a dividend of 15p. There are 200,000 of long-term debentures carrying 12% interest. These are currently trading at 220,000. Required: Calculate Nebula's weighted average cost of capital. Questions with numbers in blue have answers at the back of the book. Q1 Albatross plc has the following information about its capital: Required: What is Albatross's weighted average cost of capital? Q2 Nebula plc is looking at its sources of finance. It collects the following details. Currently, there are 500,000 ordinary shares in issue, with a market price of 1.50 and a current dividend of 0.30. The number of preference shares in issue is 300,000 , with a market price of 1.00 and a dividend of 15p. There are 200,000 of long-term debentures carrying 12% interest. These are currently trading at 220,000. Required: Calculate Nebula's weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts