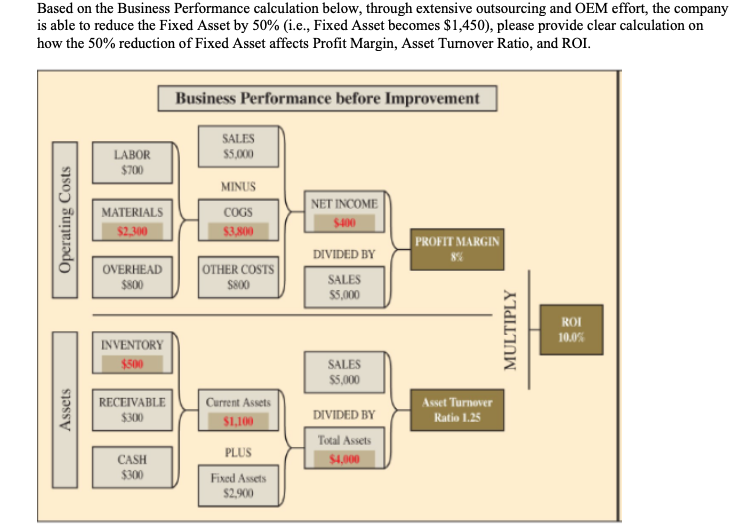

Question: Based on the Business Performance calculation below, through extensive outsourcing and OEM effort, the company is able to reduce the Fixed Asset by 50% (i.e.,

Based on the Business Performance calculation below, through extensive outsourcing and OEM effort, the company is able to reduce the Fixed Asset by 50% (i.e., Fixed Asset becomes $1,450), please provide clear calculation on how the 50% reduction of Fixed Asset affects Profit Margin, Asset Turnover Ratio, and ROI Business Performance before Improvement SALES $5,000 LABOR $700 MINUS NET INCOME MATERIALS COGS $400 $2.300 $3,800 PROFIT MARGIN DIVIDED BY OTHER COSTS OVERHEAD SALES $5,000 $800 $800 ROI 10.0% INVENTORY $500 SALES $5,000 RECEIVABLE $300 Current Assets Asset Turnover DIVIDED BY Ratio 1.25 $1,100 Total Assets PLUS $4,000 CASH $300 Fixed Assets $2.900 Assets Operating Costs MULTIPLY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts